CHAPTER 8

UNDERSTANDING EXCHANGE RATES

Two kinds of questions are considered in this chapter. The questions are either about the concept of purchasing power parity or the questions are numerical and deal with the interpretation of exchange rates and the impact of their change on interest rates.

PROBLEMS

1.(i)Yen per dollar=125.00 (=1/.008)

DM per dollar=1.4092 (=1/.7096)

Yen per DM=128.00/1.4092 = 88.7028

(ii)Francs per dollar=.4934 (=1/2.0268)

Pounds per dollar=4.8170 (=1/.2076)

Pounds per Franc=.4934/4.8170 = .1024

(iii)1.6019 DM per $1 US = 1.1368 $C per $1 US / 0.7096 $C per 1 DM

2.3900/1023.86 or 3900 x .0098 = $3.81. A Big Mac in Italy costs $3.81 in Canadian dollar terms.

$2.19 x 1023.86 = 2242.25 Lira is the cost in Lire of a Big Mac in Canada.

The Lire should depreciate to 1780.82 since at that exchange rate a Big Mac in Canada would cost 3900 Lire ($2.19 x 1780.82).

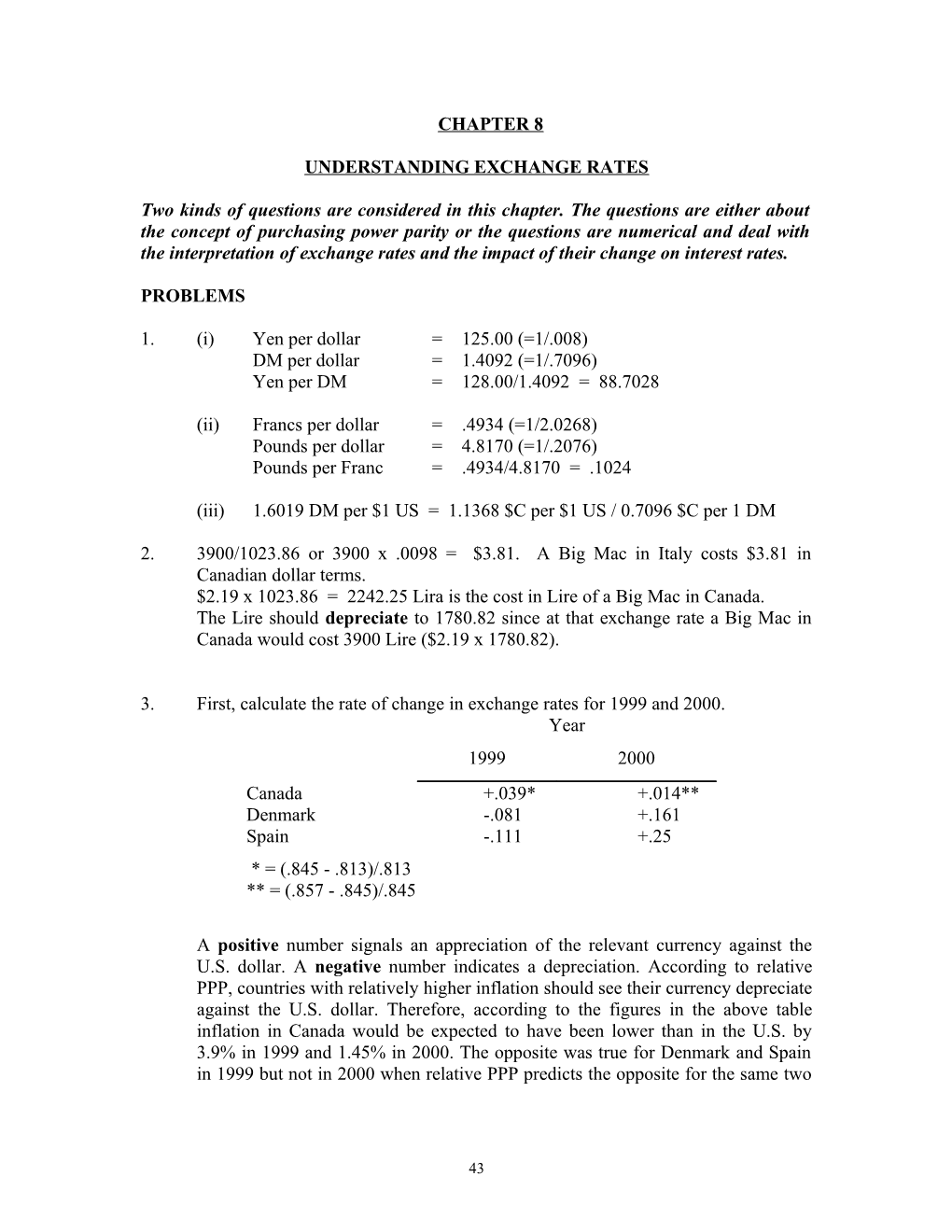

3.First, calculate the rate of change in exchange rates for 1999 and 2000.

Year1999 / 2000

Canada

Denmark

Spain / +.039*

-.081

-.111 / +.014**

+.161

+.25

* = (.845 - .813)/.813

** = (.857 - .845)/.845

A positive number signals an appreciation of the relevant currency against the U.S. dollar. A negative number indicates a depreciation. According to relative PPP, countries with relatively higher inflation should see their currency depreciate against the U.S. dollar. Therefore, according to the figures in the above table inflation in Canada would be expected to have been lower than in the U.S. by 3.9% in 1999 and 1.45% in 2000. The opposite was true for Denmark and Spain in 1999 but not in 2000 when relative PPP predicts the opposite for the same two countries. Remember, however, that such calculations are approximations and need not hold every year.

4.It is sometimes easier to think in terms of relative PPP since this concept is obviously related to absolute PPP. U.S. inflation over the period of 13 years (1990-1978) was 1.983 or 98.37% ((122/61.5) x 100) or 7.57% annually, on average, while in Canada inflation was 2.1377 or 113.77% ((119.5/55.9) x 100) or 8.75% per annum over the same period. The difference in the inflation rates, again over the 13 year period, was 15.4%. The exchange rate, by contrast, experienced a percent change of .205% over 13 years ((1.1668/1.1402) x 100) which here is a depreciation of the $C relative to the U.S. dollar. Thus, the inflation differential did not translate into a sufficient depreciation of the $C relative to the U.S. dollar, according to relative PPP.

In terms of absolute PPP the question can be addressed by calculating the real exchange rate. In 1990 the real exchange rate stood at

= 1.1668 (122/119.5) = 1.191

A value of 1 means prices are the same in the two countries. Since in 1990 is greater than one, this means that the Canadian dollar was overvalued. This is also consistent with a rate of depreciation over the period in question that is less than the difference in the inflation rates between the two countries.

5.Consider Figure 8.3 which describes a Exchange Rate Equilibrium. An undervalued Canadian dollar means that it might trade at $1.60 instead of the equilibrium value of $1.40 in the diagram. The Canadian dollar is thus undervalued. At $1.60 there is an excess supply of foreign exchange, or U.S. dollars in this case, which is the opposite result of the one depicted in the figure. Thus, the Bank of Canada must buy U.S. dollars to maintain an exchange rate at $1.60 thereby increasing its reserves of U.S. dollars.

6.

Bank of Canada / Banking SectorAssets / Liabilities / Assets / Liabilities

For Exch. / Notes / Reserves / Deposits

One way to accomplish such a transaction (see also Chapter 24 for other details about central bank transactions in the foreign exchange market) is for the Bank of Canada to simply issue notes (Bank of Canada notes) with which to buy foreign exchange. As shown in the T-account above, the Bank of Canada acquires foreign exchange by creating a debt. These notes end up in the banking sector as deposits which increases the banking sector's reserves. Then, by the multiplier process of Chapter 16, the monetary base is increased. The actual transaction, strictly speaking, involves the Exchange Fund Account, which is where foreign exchange is held since it is controlled by the Finance Department. Again, the details will be examined in Chapter 24.

7.-16,385+14,436 = -1,949 is the statistical discrepancy.

8.-14,264+3,827 = -10,437 is the capital account balance.

9.At $1.25 the currency is undervalued. It should be worth $1.20 in equilibrium which means that it should take fewer Canadian dollars in equilibrium to purchase $1 US.

10.In effect the desire to import would rise implying a rightward shift in the demand for foreign exchange. The equilibrium exchange rate would rise and a $1.20 exchange rate would then be overvalued.

11.In theory the BOP should be zero because a surplus on the current account is exactly offset by a deficit in the capital account, and vice-versa. In practice, of course, the BOP is not zero in large part because of the errors or omissions.

12.

Other things being equal, higher interest rates in Canada would make Canadian financial assets relatively more attractive. Demand for U.S. dollars would fall (D0 to D1) while the supply would rise (S0 to S1) as U.S. dollars are sold to buy into Canadian financial instruments. Since the equilibrium exchange rate falls (fewer $C needed to buy a $U.S.) to ER1 from ER0 the Canadian dollar appreciates.

13.Presumably, LF sf would fall as foreigners become less inclined to lend to Canadians. LFd would also fall as higher risk might make borrowing less attractive. The net effect on the interest rate depends on the relative size of the LF d and LF sf shifts but one would expect the equilibrium interest rate to increase. This case is easily shown in a diagram of the kind shown in Figure 8.4.

14.Calculation of the exchange rate consistent with PPP:

USA / 2.76/2.28=1.21France / 2.76/18.5=.15

Japan / 2.76/391=.007

Germany / 4.6/2.76=.60

Note that the first calculation is in $C per $US. The others are in the form of $C also in terms of one unit of the foreign currency. Some may prefer to take the reciprocal and calculate in terms of, say, ¥ per $C. In every case the $C is undervalued since it costs more $C to buy a unit of the foreign currency than PPP predicts.

15.First, calculate the ratio of prices (i.e., $C price divided by foreign price or the reciprocal in the case of the other currencies for ease of calculation). Next, calculate the percentage difference between the actual and PPP exchange rate to get the percent over or undervaluation (figures given to the right of the arrow). In the cases below the $C is always undervalued. The first column is for 1986, the second for 1989 (see Economics Focus). Answers for 1995, 1999 and 2001 are shown separately. Note that the denominator in The Economist’ version is the US dollar price whereas here it’s the $CDN price.

1986 / 1990Canada / 1.89/1.60=1.18

17.78% / 2.19/2.20=1.00

16%

Japan / 370/1.89=195.77

60% / 370/2.19=168.95

16.67%

Germany / 4.25/1.89=2.25

34.09% / 4.30/2.19=1.96

35.29%

Since, for example, in 2001 the actual exchange rate between the US and Canada was 1.56 while the relative price of the Big Mac was 1.31, the $CAD was undervalued by (1.56-1.31)/1.31=19.08%.

1995 / 1999 / 2001Canada / 2.77/2.32=1.19

16.81% / 2.99/2.43=1.23

22.76% / 3.33/2.54=1.31

19.01%

Germany / 4.80/2.77=1.73

74.14% / 4.95/2.99=1.66

38.33% / 5.1/3.33=1.53

7.69%

Japan / 391/2.77=141.16

142.86% / 294/2.99=98.33

30% / 294/3.33=88.29

-3.08%

Note: For Germany and Japan I converted the exchange rates from the Focus box into number of foreign currency units per $C (e.g., 1/.013C = 76.92¥) to arrive at the undervaluation results. This is reflected above in the calculation of relative process (e.g., 1/153=0.65, in the case of Germany relative to the Canadian Big Mac price in 2001, as shown in the Focus Box). Note also that, for Japan, the $CAD is overvalued in 2001 as indicated by the negative sign.

16.The $C is undervalued in 1985,1992, and 1993 and is overvalued in 1990. In the years when the $CAN is overvalued the PPP is less than the actual nominal exchange rate while in 1990 the PPP exchange rate was greater than the actual exchange rate. Hence, in 1990 one $US could be purchased for fewer $CAN in 1990 than would be the case if PPP held. In contrast, for the other years, more $CAN were needed to buy a $US than would be predicted under PPP.

17.We can use Figure 8.1(A) to obtain an answer to this question. Suppose that the exchange rate for the Mexican Peso is fixed below the equilibrium exchange rate given by the intersections of the demand and supply curves (i.e. below the equilibrium exchange rate of E0) . This implies that the policy of fixing the exchange rate creates an excess demand for the foreign currency (here too one can assume its the US dollar). Obviously, the reserves of foreign exchange are falling in this scenario. The lower the fixed rate relative to the equilibrium rate the faster the rate at which reserves are being depleted. This is one possible explanation of what happened in Mexico during the early 1990s, although this also begs the question of why financial markets literally woke up one day and decide that the Mexican peso was so overvalued.

18.Using Figure 8.4 (A), the consequence of setting an interest rate above the equilibrium (i.e., at the intersection of the loanable funds demanded and supplied curves or point E) is that there will be an excess supply of loanable funds. However, if devaluation or depreciation is expected then the higher returns may not be sufficient to attract domestic or foreign investors if the “risk premium” (see chapter 13) on Mexican bonds is also perceived to be higher. In this case there may be a fall in the supply of loanable funds which would effectively eliminate the excess supply (there would be a corresponding increase in the demand for $US bonds either in the US market or in the Mexican market. Mexico issues $US dollar denominated bonds).

19.By equation 8.11

ef = [(1.10)/(1.06)](1/120) = .0086

Since the interest rate is relatively higher in Canada one would expect the value of the Canadian dollar to fall in relation to the Japanese yen. The yen is, therefore, expected to appreciate against the $C since one $C will purchase fewer yen in the future. The current spot rate is 1/120 or .0083 whereas the forward rate is .0086 (or 116.28 ¥ per $C). Since the Yen is expected to appreciate by approximately 4% ((.0086 - .0083) 1.0083) the two securities are expected to roughly yield the same.

20. Yields

Canada / Foreign / Appreciation (+), Depreciation (-)11% / - / 7% / = / - / 4%

11% / - / 6.5% / = / - / 4.5%

11% / - / 12% / = / + / 1%

+, - refers to the appreciation or depreciation of the $C. When Canadian rates are higher, interest parity suggests that an expected depreciation will compensate those holding securities denominated in foreign currencies.

21.Since the actual forward rate is $2.05 per £ this means that it costs $2.05 to deliver a £ in the future. But if the implicit forward rate is $2.00 per £ then a British investment will yield more than one denominated in $C. The reason is that the actual forward premium is larger than the interest rate differential between Canadian and UK investment

22.a. This is the opposite of the case depicted in Figure 8.7(B). In other words, the direction of change in the shifts need to be reversed.

b. Recall from chapter 6 that a higher money supply initially leads to a fall in the interest rate. This can be represented by a downward shift in the RR curve shown in Figure 8.7(A). However, we also saw in chapter 6 that the liquidity effect can be offset by the combination of an income and expectations of inflation effect. Thus, as in Figure 8.7(B), the end result can be a depreciated currency.

c. This case is represented by a shift to the right in the Rf Rf curve depicted in Figure 8.7(A).

d. If a depreciation is expected then, initially, this is the same as moving down the Rf Rf curve. If the expectations turn out to be correct then a new equilibrium could be established via a shift to the right in the Rf Rf curve with a resulting depreciated spot exchange rate.

23. a. In the Table below a + means depreciation while a - means appreciation relative to the US dollar. The expression for interest rate parity was used to obtain the answer.

Canada / -Spain / -

Australia / +

Netherlands / -

Italy / -

Belgium / -

Britain / 0

US / 0

Germany / -

France / -

Japan / +

b. Possibly since 1995 was the year of the Quebec referendum. It may also be due

to the relatively small size of the Canadian market as well. Finally, returns in

Canada (especially when evaluated in real terms) may also have been relatively higher because of our relatively high productivity and prospects for better returns than on other countries.

DISCUSSION QUESTIONS

1.The theory of relative purchasing power parity would suggest that if the inflation differential is 2% but the currency depreciates by only 1% domestic goods and services would become less competitive as the rate of depreciation is not sufficient to cover the inflation differential. As we have seen, it can take some time before a disequilibrium of this kind is restored so that the time period over which such calculations are made is obviously a consideration.

2.The section on real exchange rates and the PPP is relevant here. One reason for persistent disequilibria is that prices adjust slowly so that it will take some time for a disequilibrium to be corrected. Second, economies are always subject to shocks so that even if, following an earlier shock, the exchange rate begins to settle back toward the equilibrium there might be an new shock that moves it away from the equilibrium again. Also, it is possible that the data used to make PPP type calculations exaggerate the extent of the disequilibrium since many non-traded goods prices will be included in the price index used in the calculations.

3.Forex markets operate 24 hours a day around the world and, more importantly, news travels instantly so traders, using their computer systems, will be able to detect any deviations in cross-rates almost instantaneously and take advantage of the profitable opportunities.

4.The discussion just before the discussion on exchange rate regimes provides the answer. The most important point, however, is to understand the distinction between “hot” money and long-term investment. The latter seeks out the highest return regardless of location and is apt to leave as quickly as it arrives if more profitable opportunities exist elsewhere.

5.See the discussion and numerical example (Table 8.4) in the section on

International Linkages in Interest Rates for the answer.

6.Since Canadian inflation is lower than inflation in any of the other countries the theory of relative purchasing power parity predicts that the $CAN will appreciate against all these currencies. Whether they will all appreciate at once or at different rates over time is a different question since we trade with the US far more than we do with either Japan or the UK.

7.Using Figure 8.7(A) the result is depicted by a shift in the RR curve resulting in a depreciated currency.

8.The relative form of PPP states that the difference between domestic and foreign inflation rates is explained by the rate of change in the exchange rate, under floating exchange rates. Thus, for example, if Canada’s inflation rate is relatively higher then the $C will depreciate. Similarly, interest rate parity argue that the differential between domestic and foreign interest rates is captured by the expected rate of appreciation or depreciation. Since the latter is partly a function of inflation expectations, a country whose currency is expected to depreciate is also one whose inflation rate is likely to be higher. There is, therefore, a connection between interest rate parity and PPP.

9.A current account deficit simply means that the balance of merchandise trade, trade in services, and in investment income, is negative. Since, by definition, the overall balance of payments is nil, a deficit in the current account must be offset by a surplus in the capital account. A country in such a position should be concerned only to the extent that domestic consumption is in excess of domestic production and is therefore being financed from abroad. That such a situation can be sustained for a long period of time is not in doubt (especially if the economy is growing rapidly enough). However, if borrowing from abroad is relatively more costly, say, than domestic borrowing a prolonged current account deficit is not desirable. There are also political implications as the case of U.S./Japan trade in the 1980s and 1990s clearly attests.

10.There are two views about how a Balance of Payments disequilibrium is corrected: the monetary approach and the absorption approach. Choose one of the approaches. Next, decide whether the exchange rate is fixed or not. Finally, trace the solution verbally or by using either the national income identity or by tracing out how changes in reserves and the domestic money supply are connected to changes in a balance of payments disequilibrium

11.Unless the exchange rate happens to be in equilibrium there will either be an excess demand or supply of foreign exchange at most times under fixed exchange rates. The typical case of a speculative attack is when a central bank must draw down its foreign exchange reserves to maintain a particular fixed exchange rate. Eventually, a country runs out of foreign exchange and the fixed exchange rate can no longer be supported and must be changed.

12.Technically, the balance of payments must always be nil. Only the current account or the capital account can be in surplus. If the current account is in surplus then, in the monetary approach to the balance of payments, reserves of foreign exchange will increase which will be translated into a higher domestic money supply, which can be inflationary, according to the Quantity Theory of Money.

13.Technically, under purely flexible exchange rates, the foreign exchange market clears all the time. There cannot be excess demand or supply of foreign exchange that would affect the domestic money supply as under a fixed exchange rate system.

14.Because the exchange rate always adjusts to clear the market for foreign exchange, domestic policy makers are able to pursue, say, their own interest rate policy so long as they are unconcerned about what happens to the exchange rate. Needless to say, the real world doesn't quite work this way as governments tend to intervene and manage exchange rates.

15.Sterilization is the process of offsetting a potential change in the money supply as a result of the fixing (rigidly or in a band) of the exchange rate. For example suppose that, because the exchange rate is fixed, there is an inflow of foreign currencies which would ordinarily increase the domestic money supply as soon as the recipients exchange them for domestic currency. In order to offset this increase the central bank would sell government bonds (or in countries other than Canada increase the reserve requirements perhaps) to the private sector leaving the money supply unchanged.

16.Government deficits and current account deficits both increase a country’s indebtedness. In the former, the debt is usually held domestically; in the latter, there is a greater chance that the debt is held by foreigners. In both cases, there is the worry that flexibility in conducting fiscal policy is reduced, with a possible impact on interest rates and inflation. In the case of persistent current account deficits there is vulnerability toward foreign borrowers.