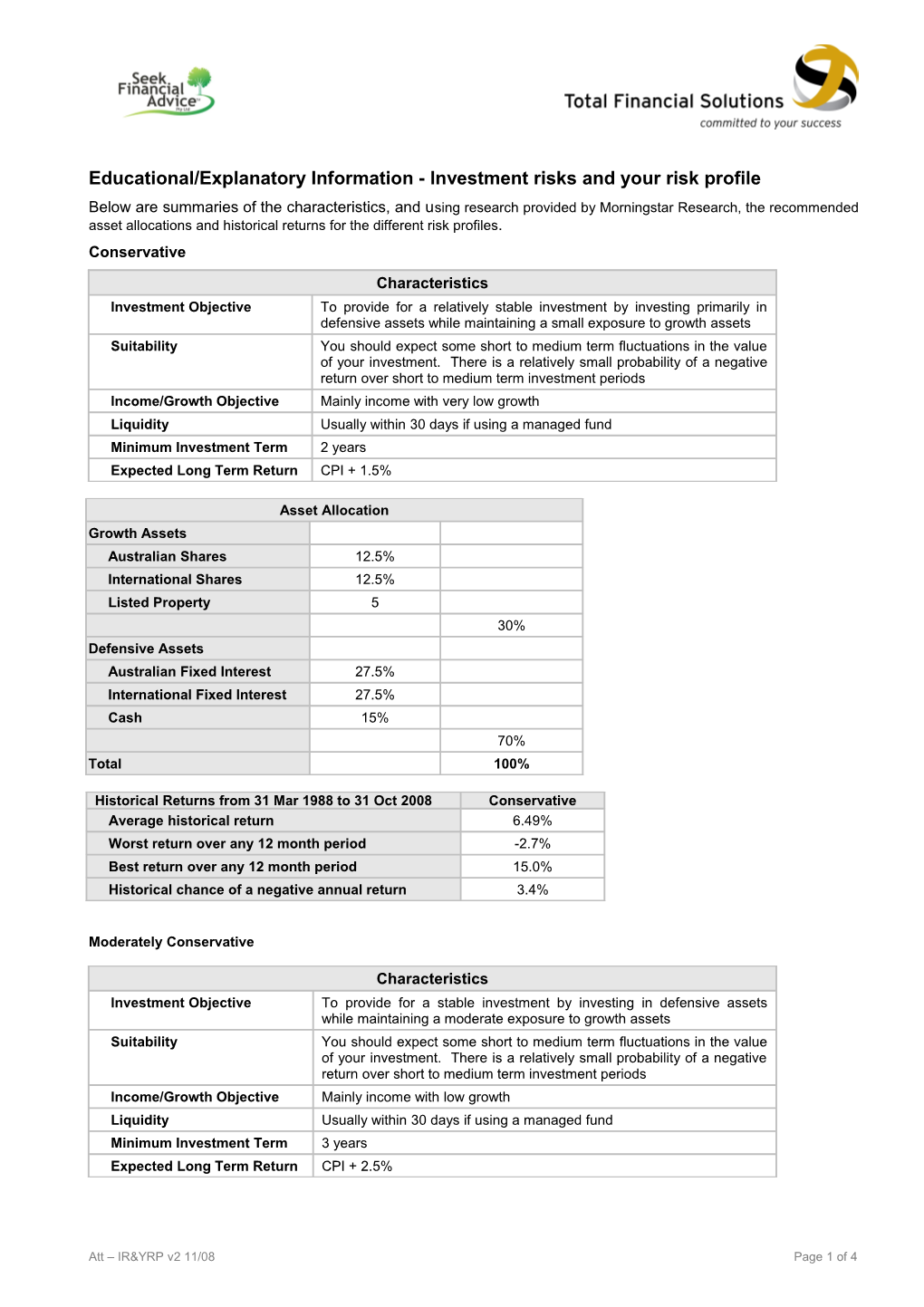

Educational/Explanatory Information - Investment risks and your risk profile

Below are summaries of the characteristics, and using research provided by Morningstar Research, the recommended asset allocations and historical returns for the different risk profiles.

Conservative

CharacteristicsInvestment Objective / To provide for a relatively stable investment by investing primarily in defensive assets while maintaining a small exposure to growth assets

Suitability / You should expect some short to medium term fluctuations in the value of your investment. There is a relatively small probability of a negative return over short to medium term investment periods

Income/Growth Objective / Mainly income with very low growth

Liquidity / Usually within 30 days if using a managed fund

Minimum Investment Term / 2 years

Expected Long Term Return / CPI + 1.5%

Asset Allocation

Growth Assets

Australian Shares / 12.5%

International Shares / 12.5%

Listed Property / 5

30%

Defensive Assets

Australian Fixed Interest / 27.5%

International Fixed Interest / 27.5%

Cash / 15%

70%

Total / 100%

Historical Returns from 31 Mar 1988to 31Oct 2008 / Conservative

Average historical return / 6.49%

Worst return over any 12 month period / -2.7%

Best return over any 12 month period / 15.0%

Historical chance of a negative annual return / 3.4%

Moderately Conservative

CharacteristicsInvestment Objective / To provide for a stable investment by investing in defensive assets while maintaining a moderate exposure to growth assets

Suitability / You should expect some short to medium term fluctuations in the value of your investment. There is a relatively small probability of a negative return over short to medium term investment periods

Income/Growth Objective / Mainly income with low growth

Liquidity / Usually within 30 days if using a managed fund

Minimum Investment Term / 3 years

Expected Long Term Return / CPI + 2.5%

Asset Allocation

Growth Assets

Australian Shares / 21%

International Shares / 21%

Listed Property / 8%

50%

Defensive Assets

Australian Fixed Interest / 20%

International Fixed Interest / 20%

Cash / 10%

50%

Total / 100%

Historical Returns from 31 Mar 1984 to 31 Oct 2008 / Mod. Conservative

Average historical return / 8.80%

Worst return over any 12 month period / -10.2%

Best return over any 12 month period / 28.9%

Historical chance of a negative annual return / 6.7%

Balanced

BalancedInvestment Objective / To provide for a balanced investment return by investing predominately in growth assets with a moderate level of defensive assets

Suitability / You should expect short to medium term fluctuations in the value of your investment. There is a moderate probability of a negative return over short to medium term investment periods

Income/Growth Objective / Balance between income and growth

Liquidity / Usually within 30 days if using a managed fund

Minimum Investment Term / 4 years

Expected Long Term Return / CPI + 3.5%

Asset Allocation

Growth Assets

Australian Shares / 30%

International Shares / 30%

Listed Property / 10%

70%

Defensive Assets

Australian Fixed Interest / 12.5%

International Fixed Interest / 12.5%

Cash / 5%

30%

Total / 100%

Historical Returns from 30 Nov 1986 to 31 Oct 2008 / Balanced

Average historical return / 8.30%

Worst return over any 12 month period / -20.1%

Best return over any 12 month period / 25.1%

Historical chance of a negative annual return / 14.7%

Growth

GrowthInvestment Objective / To provide for a strong investment return by investing heavily in growth assets with a minimal exposure to defensive assets

Suitability / You should expect short to medium term fluctuations in the value of your investment. There is a high probability of a negative return over short to medium term investment periods

Income/Growth Objective / More growth than income

Liquidity / Usually within 30 days if using a managed fund

Minimum Investment Term / 5 years

Expected Long Term Return / CPI + 4.5%

Asset Allocation

Growth Assets

Australian Shares / 37.5%

International Shares / 37.5%

Listed Property / 10%

85%

Defensive Assets

Australian Fixed Interest / 7.5%

International Fixed Interest / 7.5%

Cash / 0%

15%

Total / 100%

Historical Returns from 30 Nov 1983 to 31Oct 2008 / Growth

Average historical return / 9.92%

Worst return over any 12 month period / -32.5%

Best return over any 12 month period / 60.8%

Historical chance of a negative annual return / 18.1%

High Growth

High GrowthInvestment Objective / To provide for a high investment return by investing solely in growth assets with no exposure to defensive assets

Suitability / You should expect to experience short to medium term fluctuations in the value of your investment. There is a high likelihood of a negative return in a given investment period

Income/Growth Objective / Mainly growth with low income

Liquidity / Usually within 30 days if using a managed fund

Minimum Investment Term / 7 years

Expected Long Term Return / CPI + 5.5%

Asset Allocation

Growth Assets

Australian Shares / 50%

International Shares / 50%

Listed Property / 0%

100%

Defensive Assets

Australian Fixed Interest / 0%

International Fixed Interest / 0%

Cash / 0%

0%

Total / 100%

Historical Returns from 30 Sep 1987 to 31Oct 2008 / High Growth

Average historical return (%pa) / 6.98%

Worst return over any 12 months (%) / -30.8%

Best return over any 12 months (%) / 34.8%

Historical chance of a negative annual return / 22.7%

The historical returns above should not be regarded as a prediction of the future. They are historical averages only. It is important to note that:

- All profiles have negative returns from time to time, i.e. the value of your investment can fall over the short term.

- The chance of a negative return, (i.e. a loss of capital), in any one year increases as more growth assets are included. You should note that just because the chance of a negative return in a balanced fund for example, is 1 year in every 7 years, this does not mean that every 7 years the investorwith a balanced portfolio will have a negative return. Returns, both positive and negative, are unpredictable and the investor with a balanced portfolio may have negative returns 2 years in a row and positive returns for the next 12 years.

You should ensure you fully understand the relationship between risk and return when considering the investment recommendations contained in this SoA. Please ask me questions about any aspects of these matters you are not sure about.

Att – IR&YRP v2 11/08Page 1 of 4