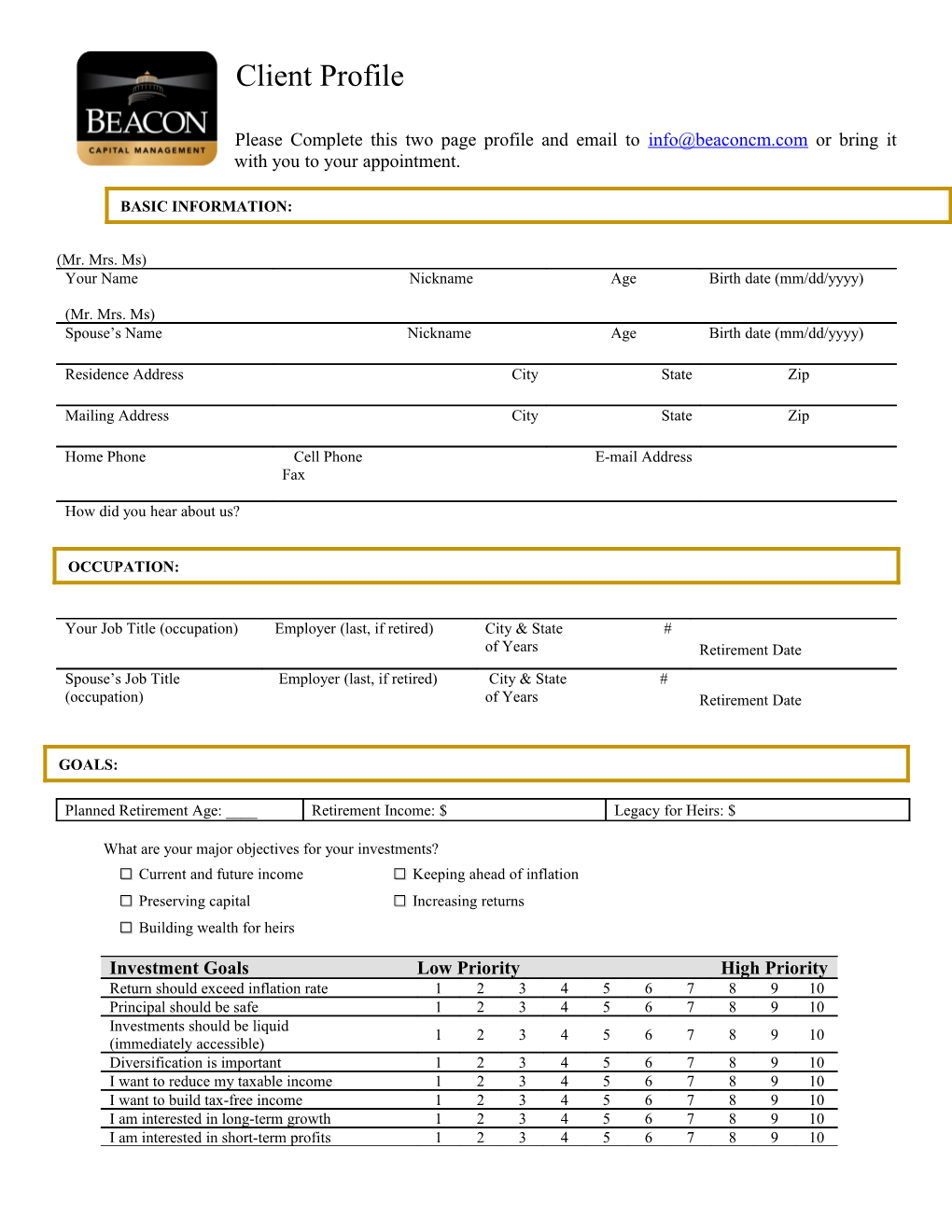

Client Profile

Please Complete this two page profile and email to or bring it with you to your appointment.

(Mr. Mrs. Ms)

Your Name(Mr. Mrs. Ms) / Nickname / Age / Birth date (mm/dd/yyyy)

Spouse’s Name / Nickname / Age / Birth date (mm/dd/yyyy)

Residence Address / City / State / Zip

Mailing Address / City / State / Zip

Home Phone / Cell Phone Fax / E-mail Address

How did you hear about us?

Your Job Title (occupation) / Employer (last, if retired) / City & State # of Years / Retirement Date

Spouse’s Job Title (occupation) / Employer (last, if retired) / City & State # of Years / Retirement Date

Planned Retirement Age: ____ / Retirement Income: $ / Legacy for Heirs: $

What are your major objectives for your investments?

□Current and future income□Keeping ahead of inflation

□Preserving capital□Increasing returns

□Building wealth for heirs

Investment Goals Low Priority High PriorityReturn should exceed inflation rate / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

Principal should be safe / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

Investments should be liquid (immediately accessible) / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

Diversification is important / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

I want to reduce my taxable income / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

I want to build tax-free income / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

I am interested in long-term growth / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

I am interested in short-term profits / 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8 / 9 / 10

How much investing experience do you have (in years)? Stocks______Mutual Funds ______

Bonds ______Variable Annuities ______REIT’s ______Options ______

I expect to start drawing income from this investment:

□Not for at least 20 years□Not now, but within 5 years

□In 10 to 20 years□Immediately

□In 5 to 10 years

What do you think a reasonable rate of return is? You _____% Spouse _____%

How much short term, immediate cash do you want available? You $______Spouse $______

What percentage of your money are you comfortable with having market-related risk?

You _____% Spouse _____%

On a scale of 1-10, what is your risk tolerance? (1= ultra conservative, 10 = very aggressive)

You: 1 2 3 4 5 6 7 8 9 10 Spouse: 1 2 3 4 5 6 7 8 9 10

What percentage or dollar amount of your money would you be OK with losing?

You ______% or $ ______Spouse ______% or $ ______

I have reviewed my Client Profile and agree that this information is accurate.

Client Signature / Date / Print NameClient Signature / Date / Print Name

Any rates of return shown are for illustrative purposes only and are neither guaranteed nor implied.

Actual rates of return will be based upon the actual performance of selected investments.

Taxes and fees are not a consideration in the illustrated returns.

Securities offered through Kalos Capital, Inc. located at 11525 Park Woods Circle, Alpharetta, Georgia 30005, (678) 356-1100, TD Ameritrade Institutional Services located at 5010 Wateridge Vista Dr., San Diego, California 92121 (800) 431-3500, Fidelity located at 100 Crosby Pkwy, Covington, KY 41015, 800-544-5555, and investment advisory services offered through Beacon Capital Management, a Registered Investment Advisor with the Tennessee Securities Division. Beacon Capital Management is neither an affiliate nor subsidiary of Kalos Capital, Inc. or TD Ameritrade Institutional Services, or Fidelity, and does not provide tax and legal services.

Thank You