Is There More In Store With Brixmor?

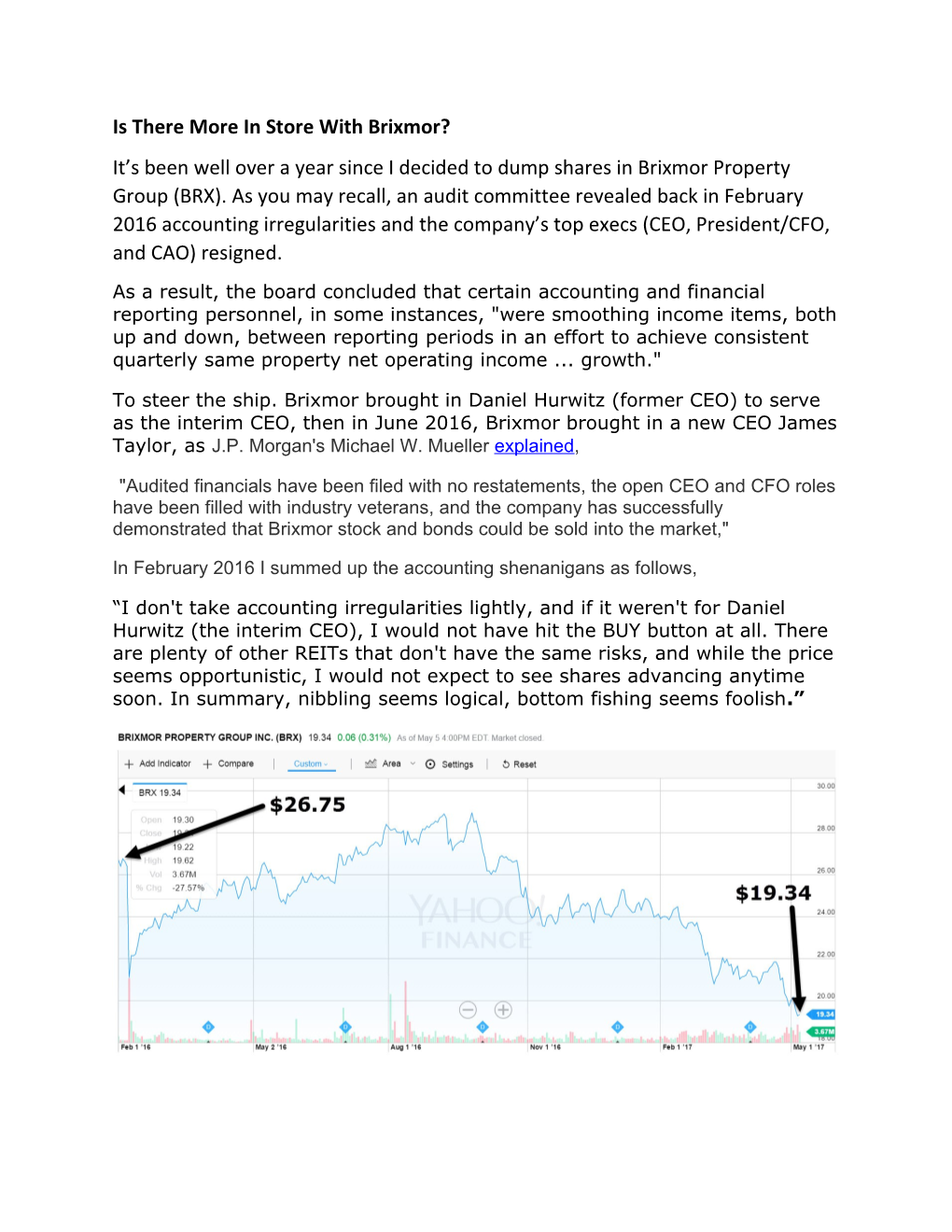

It’s been well over a year since I decided to dump shares in Brixmor Property Group (BRX). As you may recall, an audit committee revealed back in February 2016 accounting irregularities and the company’s top execs (CEO, President/CFO, and CAO) resigned.

As a result, the board concluded that certain accounting and financial reporting personnel, in some instances, "were smoothing income items, both up and down, between reporting periods in an effort to achieve consistent quarterly same property net operating income ... growth."

To steer the ship. Brixmor brought in Daniel Hurwitz (former CEO) to serve as the interim CEO, then in June 2016, Brixmor brought in a new CEO James Taylor, as J.P. Morgan'sMichael W. Muellerexplained,

"Audited financials have been filed with no restatements, the open CEO and CFO roles have been filled with industry veterans, and the company has successfully demonstrated that Brixmor stock and bonds could be sold into the market,"

In February 2016 I summed up the accounting shenanigans as follows,

“I don't take accounting irregularities lightly, and if it weren't for Daniel Hurwitz (the interim CEO), I would not have hit the BUY button at all. There are plenty of other REITs that don't have the same risks, and while the price seems opportunistic, I would not expect to see shares advancing anytime soon.In summary,nibbling seems logical, bottom fishing seems foolish.”

In turns out that my recommendation was a good one, BRX did recover after the C-suite changes, and now the shares are getting crushed as a result of the broader retail environment.

In my constant pursuit of value-oriented REIT investments, it’s now time to take a closer look at Brixmor, now that the dust has settled…perhaps there is more in store for Brixmor!

I Was Warming Up To Brixmor

Up until the accounting hiccup, I was warming up to BRX, a shopping center REIT that went public in October 2013 as a result of the spin-off from Blackstone (BX).

While there are other shopping center REITs that focus on grocery-anchored assets (i.e. Regency Centers (NYSE:REG) andWeingarten Realty (NYSE:WRI)), Brixmor's differentiated platform is based upon its wide footprint of 512 grocery-anchored centers that span coast to coast. This portfolio, with gross leasable square footage of 86 million square feet, makes Brixmor one of the largest "pure play" wholly owned grocery-anchored platform in the U.S.

As of the latest quarter (Q4-16), Brixmor's average shopping center was around 168,000 square feet with average base rent per square foot of $12.99. The average grocery sales in BRX’s shopping centers is $550/sf.

Brixmor is based in New York City and the company has three strategically based operating areas. These regional offices service leasing and property management functions that provide Brixmor's customers with enhanced services. Brixmor is a landlord for over 5,600 national, regional, and local tenants.

Brixmor enjoys a strong tenant profile with no significant concentration. Ten of the company's largest tenants account for only 18.4% of ABR (average base rent) and the largest tenant, Kroger (NYSE:KR), accounts for only 3.3%. Accordingly, Brixmor's scale and footprint provides superior access to retailers nationwide.

BRX invest sin non-discretionary & value-oriented centers with a strong service component. BRX’s tenants have a strong credit profile with meaningful diversification. Although there are weak tenants on the roster, BRX insists that they are “points of opportunity”. For example, K-Mart’s in-place ABR/SF is $4.41 and Conn’s and hhgregg’s in place ABR/sf is $10.17.

UnlikeWhitestone REIT(NYSEMKT:WSR) that focuses on local "mom & pop" tenants, Brixmor has a portfolio of "best in class" tenants that are deemed eCommerce defensive. In fact, BRX’s primary competitive advantage is the highly productive tenancy of grocery and vakue-oriented tenants.

Sector Leading Productivity

BRX has set records since the IPO, in Q1-17 the company increased leased occupancy by 10 bps to 92.5% and small shop occupancy increased 90 bps to 84.8%.

Leasing volume in 2016 was also a record 13.7 million SF executed. BRX’s new lease volume in 2016 was 3.4 million SF, more than 3x the peer group average.

Also BRX generated peer leading new lease rent spreads in 2016 of 31.3%, demonstrating an efficient and discipline use of leasing capital.

Driving BRX’s success is the fact that the company has broadened its outreach to the growing retail segment. The company executed over 900,000 square feet of new leases in 2016 with restaurants, theatres, and fitness centers – up 20% over the last three-year average.

As you can see below, BRX’s tenant base provides for strong organic growth as evidenced by the growing number of leases with embedded rent bumo:

Also, BRX has been reducing its reliance on lease options, that provides better control of space at the end of the lease term:

BRX’s portfolio is equipped with visible drivers of forward internal growth. Here’s a snapshot of the company’s lease expiration schedule, demonstrating strong mark-to-market opportunities:

The forward-looking growth drivers for BRX are appealing:

BRX’s small shop occupancy at centers where a redevelopment o repositioning has been completed in the past 5 years has improved 960 bps since December 2012. Future redevelopments are catalysts for improvement: (1) properties are 86.8% leased (600 bps below portfolio average, and (2) small shops are 78.1% leased (700 bps below portfolio average).

BRX’s primary competitive advantage is its reinvestment in (1) redevelopment, (2) anchor store repositioning, and (3) outparcel development. BRX delivered a total of 41 projects in 2016 totaling $67 million at an NOI yield of 12%; $190 million f projects are in-process with an average expected NOI yield of ~11%.

BRX has significant untapped potential to drive growth through additional redevelopment:

Here’s a snapshot of in-place redevelopment:

The Balance Sheet

During Q1-17 BRX issued $400 million of tenure unsecured debt using the proceeds to repay $390 million of the $1 billion Tranche A Term Loan that matures in July of 2018. This transaction addressed the only outsized maturity in BRX’s forward maturity schedule, increasing the weighted-average duration to five years and further positioning the company with the flexibility necessary to be entirely opportunistic as it relates to future capital raises. (The chart below is from a Q4-16 presentation).

As of quarter end BRX had over $1 billion of availability on its revolving credit facility and the company intends to “accelerate” disposition activity in the coming quarters “based on both assets under contract today and assets in advanced stages of marketing.”

BRX is rated BBB- by S&P (in-line with RPAI, DDR, WPG, and KRG). WRI is rated BBB and KIM and REG are rated BBB+. FRT is the only shopping center REIT rated A- (by S&P).

In Q1-17 BRX affirmed 2017 FFO guidance with a range of $2.5 to $2.12 per diluted share, while providing slightly modified expectations for non-cash rental income and interest expense, largely to reflect actual results in transaction activity in the first quarter. BRX also affirmed its same property NOI growth expectation of 2% to 3%.

The company’s range contemplates a variety of possible outcomes as it relates to both the timing and magnitude of potential sore closures from hhgregg, Radio Shack, COD Men's, Payless and Rue 21. BRX’s CFO, Angela Aman, remarked on the earnings call,

“…stronger than anticipated performance in the first quarter has partially mitigated the impact of recent retailer bankruptcies and store closing announcement and we remain confident in the 2% to 3% expectation established last quarter.”

I’m Moving Brixmor Back To STRONG BUY

BRX’s FFO for Q1-17 was $0.53 per share representing growth of 4.4% excluding non-cash GAAP rental income and lease terminations fees. This growth was primarily driven by higher same property NOI and a lower interest expense.

Same Property NOI growth was 3.2% in Q1-17, well above the indication the company gave on last quarter's call (that it would be at or below the low end of the full-year guidance range of 2% to 3%). This outperformance was largely driven by base rent which contributed 250 bps to same property growth during the quarter.

I also give the new management team credit for moving the needle, and demonstrating success in growing income and profits. As evidenced below, BRX has grown its annual dividend by an average of 8.6% since going public:

Let’s compare BRX’s dividend yield with the peer group:

I like the 5.4% yield, but let me tell you what I really like about this REIT:

This chart (above) is a Payout Ratio analysis, and as you can see, BRX has the lowest Payout Ratio (50%) in the shopping center REIT sector. In other words, there is plenty of capacity to grow.

Now let’s take a look at BRX’s P/FFO multiple (and the peer group):

BRX is cheap, but remember that WSR is not rated (and has no geographic diversification…and a high payout ratio), WHLR is a wreck (that is the title to my upcoming article), DDR has negative growth forecasted, and WPG is just plain “speculative”. In other words, pound for own, BRX is the best Shopping Center REIT to own (based on fundamentals and value).

This chart illustrates FFO/share for all Shopping Center REITs (BRX in blue):

Blackstone is no longer a stakeholder in Brixmor, here’s how the shares have performed YTD compared with the peers:

Before I explain my STRONG BUY recommendation, you must remember that there are a growing number of tenant bankruptcies and BRX could experience a decline in cash flow in the future. However, BRX also has a highly diversified portfolio, and combined with a low payout ratio, BRX is well-positioned to mitigate the headwinds.

BRX’s below market rent basis of assets (as a result of long-term under investment in the portfolio) and well located and highly productive centers, should allow the company to generate returns much higher than the company’s cost of capital. I look forward to meeting the management team at NAREIT in June, and based upon my analysis, I believe there is much more in store for Brixmor!

Note: I will be attending the annual ReCon (Retail Conference) in Las Vegas in 10 days. While there, I will be meeting with over 2 dozen REIT CEOs. For more information, CKICK HERE.