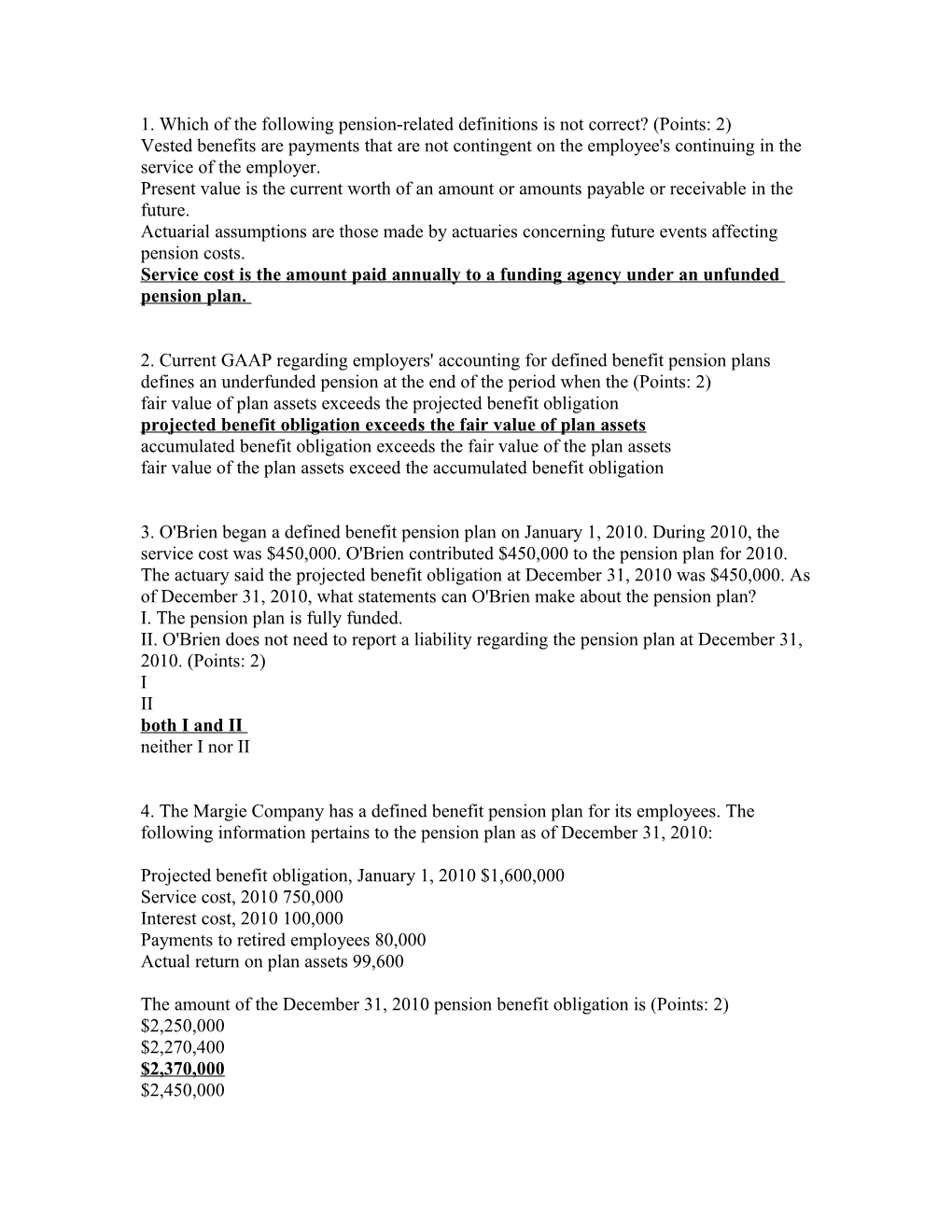

1. Which of the following pension-related definitions is not correct? (Points: 2)

Vested benefits are payments that are not contingent on the employee's continuing in the service of the employer.

Present value is the current worth of an amount or amounts payable or receivable in the future.

Actuarial assumptions are those made by actuaries concerning future events affecting pension costs.

Service cost is the amount paid annually to a funding agency under an unfunded pension plan.

2. Current GAAP regarding employers' accounting for defined benefit pension plans defines an underfunded pension at the end of the period when the (Points: 2)

fair value of plan assets exceeds the projected benefit obligation

projected benefit obligation exceeds the fair value of plan assets

accumulated benefit obligation exceeds the fair value of the plan assets

fair value of the plan assets exceed the accumulated benefit obligation

3. O'Brien began a defined benefit pension plan on January 1, 2010. During 2010, the service cost was $450,000. O'Brien contributed $450,000 to the pension plan for 2010. The actuary said the projected benefit obligation at December 31, 2010 was $450,000. As of December 31, 2010, what statements can O'Brien make about the pension plan?

I. The pension plan is fully funded.

II. O'Brien does not need to report a liability regarding the pension plan at December 31, 2010. (Points: 2)

I

II

both I and II

neither I nor II

4. The Margie Company has a defined benefit pension plan for its employees. The following information pertains to the pension plan as of December 31, 2010:

Projected benefit obligation, January 1, 2010 $1,600,000

Service cost, 2010 750,000

Interest cost, 2010 100,000

Payments to retired employees 80,000

Actual return on plan assets 99,600

The amount of the December 31, 2010 pension benefit obligation is (Points: 2)

$2,250,000

$2,270,400

$2,370,000

$2,450,000

5. The Susan Company has a defined benefit pension plan for its employees. The following information pertains to the pension plan:

Projected benefit obligation, December 31, 2010 $1,680,000

Fair value of plan assets, December 31, 2010 1,739,000

Accrued/prepaid pension cost (asset), December 31, 2009 51,300

The December 31, 2010 adjusting journal entries include a (Points: 2)

debit to Accrued/Prepaid Pension Cost for $7,700

debit to Other Comprehensive Income for $7,700

credit to Other Comprehensive Income for $110,300

credit to Accrued/Prepaid Pension Cost for $110,300

6. Current GAAP requires that the financial statements issued by a funding agency for a company's pension plan include all of the following except (Points: 2)

information about the net assets (at fair value) available for benefits at the end of the plan year

a financial statement (on a cash basis) presenting information about the pension payments to retirees

a financial statement containing information about the changes during the year in the net assets available for benefits

information about the actuarial present value of accumulated plan benefits

7. Disclosures for vested benefits (Points: 2)

are not required

are related to the projected benefit obligation

are related to the accumulated benefit obligation

are related to the plan assets

8. Which of the following is not a component of the net periodic pension expense to be reported on a company's income statement? (Points: 2)

interest cost

unrecognized past service cost

service cost

expected return on plan assets

9. Current GAAP defines the required calculations for all of the following items except (Points: 2)

periodic pension expense

the funded status of the plan

the accrued/prepaid pension cost to be reported by the employer

the minimum required amount to be funded

10. If an employer were to account for a defined benefit pension plan on the cash basis, it would be a violation of the (Points: 2)

going-concern assumption

accrual concept

separate entity concept

double-entry accounting

1. Which of the Following Pension-Related Definitions Is Not Correct? (Points: 2) Vested