ABOUT THE PHILIPPINE ECONOMY

Performance Overview

The Philippines, an archipelago in Southeast Asia composed of over 7,500 islands and with a population of over 100 million, is one of the fastest growing and among the most resilient economies in Asia and the world.

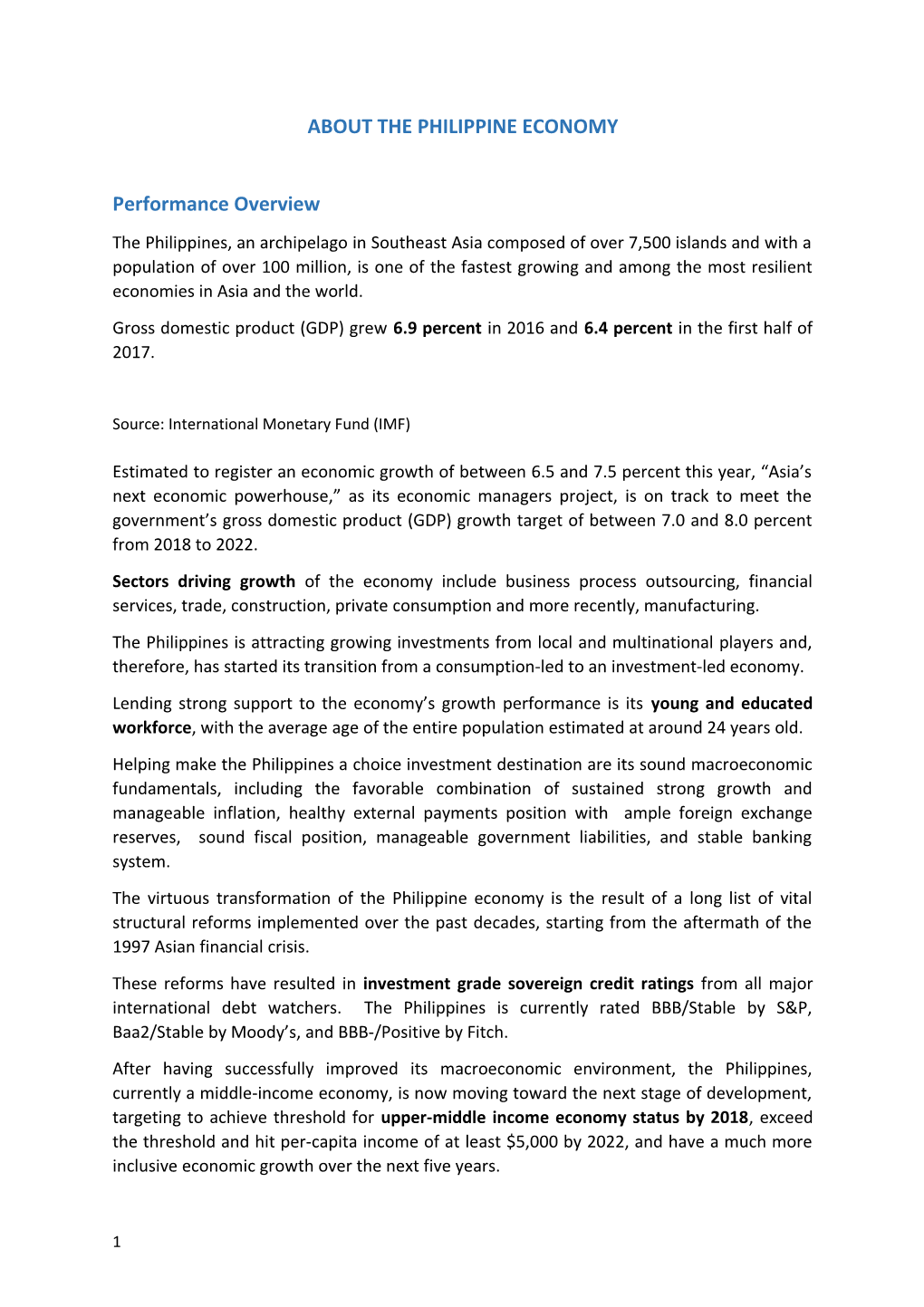

Gross domestic product (GDP) grew6.9 percent in 2016 and 6.4 percent in the first half of 2017.

Source: International Monetary Fund (IMF)

Estimated to register an economic growth of between 6.5 and 7.5 percent this year, “Asia’s next economic powerhouse,” as its economic managers project, is on track to meet the government’s gross domestic product (GDP) growth target of between 7.0 and 8.0 percent from 2018 to 2022.

Sectors driving growth of the economy include business process outsourcing, financial services, trade, construction, private consumption and more recently, manufacturing.

The Philippines is attracting growing investments from local and multinational players and, therefore, has started its transition from a consumption-led to an investment-led economy.

Lending strong support to the economy’s growth performance is its young and educated workforce, with the average age of the entire population estimated at around 24 years old.

Helping make the Philippines a choice investment destination are its sound macroeconomic fundamentals, including the favorable combination of sustained strong growth and manageable inflation, healthy external payments position with ample foreign exchange reserves, sound fiscal position, manageable government liabilities, and stable banking system.

The virtuous transformation of the Philippine economy is the result of a long list of vital structural reforms implemented over the past decades, starting from the aftermath of the 1997 Asian financial crisis.

These reforms have resulted in investment grade sovereign credit ratings from all major international debt watchers. The Philippines is currently rated BBB/Stable by S&P, Baa2/Stable by Moody’s, and BBB-/Positive by Fitch.

After having successfully improved its macroeconomic environment, the Philippines, currently a middle-income economy, is now moving toward the next stage of development, targeting to achieve threshold for upper-middle income economy status by 2018, exceed the threshold and hit per-capita income of at least $5,000 by 2022, and have a much more inclusive economic growth over the next five years.

Infrastructure Development Agenda

These goals are supported by the government’s rising investments in human capital and infrastructure development.

With regard to the latter, the government in April 2017 launched the “Build, Build, Build”program, under which it will spend between $160 billion and $170 billion on big-ticket public infrastructure projects over the next five years that will significantly ease mobility in the country and spread growth across its regions.

With the “Build, Build, Build”program, the government’s infrastructure spending will rise consistently every year until it hits 7.3 percent of GDP by 2022.

Philippine National Government’s Infrastructure Spending as Share of GDP (%)

Source: Department of Budget and Management

Projects are wide-ranging, including expressways, airports, mass transit systems, and farm-to-market roads, and will be constructed in and out of key urban areas.

Financing of the projects will come from different sources, including proceeds of the Comprehensive Tax Reform Program, package 1 of which is already on advanced stageof deliberation in Congress, official development assistance from bilateral and multilateral partners, and private-sector investors.

(For more information about the infrastructure projects, please click on the following link:

Ease of Doing Business Initiatives

Keen on significantly enhancing the ease of doing business in the country, the government has embarked on major reform programs.

One is the establishment of the TradeNet Platform, an online portal that will have 66 government agencies onboard over the next two to three years so that businesses may do the necessary transactions with these institutions by simply logging on to just one website. The same platform will eventually be linked to the ASEAN single window gateway, benefiting entities doing cross-border trade.

Another is the creation of the Philippine Business Data Bank (PBDB), which will hook up the Department of Trade and Industry, the Securities and Exchange Commission, the country’s economic zones, and over 1,600 local government units. PBDB will allow online processing of business permits.

Also, there is an ongoing modernization initiative within the Department of Finance family, which will pave the way for much easier processes in paying taxes and duties with the Bureau of Internal Revenue and the Bureau of Customs, respectively.

At the same time, the Department of Trade and Industry is putting up “Negosyo” (Business) Centers all over the country. A Negosyo Center serves as a one-stop shop for micro, small, and medium enterprises (MSMEs) where they get various forms of information and assistance, such as on accessing government grants and loans, registering a business, managing a business, and accessing the right markets.

Moreover, the government is pursuing the implementation of a national ID system, which will help ease a wide range of transactions, such as getting financing and obtaining documents from various public institutions.

The government is also working on the passage of the proposed “Expanded Red Tape Act,” which seeks to impose required periods within which applications for government permits and licenses should be processed.

A credit information system will also be operational in the first semester of 2018. This will allow lenders to share and access credit information. This is seen to help MSMEs of good credit standing to more easily access loans from formal channels.

Lending strong support to the abovementioned initiatives are the government’s strong anti-corruption stance, which redounds to the integrity of public service delivery by government entities to all stakeholders, including businesses.

All efforts toward enhancing the ease of doing business areexpected to help realize the government’s goal for the Philippines to hit upper 20 percent of global rankings for the Ease of Doing Business survey by the World Bank Group, as well as similar or related global surveys, by 2022.

Investment Policy Environment and Updates

The Philippine economy, which is already open for foreign businesses in a wide range of sectors, is further opening up to welcome even more investments. The government is currently reviewing its foreign investment negative list, with the aim of increasing the number of industries that will allow 100 percent foreign ownership of businesses. Among the areas being eyed for further liberalization are retail trade, professions, public utilities (e.g., telecommunications) and contractors.

Worth mentioning among the recent liberalization efforts is the passage in July 2014 of a law fully liberalizing the banking sector. The law allows foreigners to fully own banks in the country. Since the enactment of the law, Republic Act 10641, 10 foreign banks have already set up operations in the Philippines, and more are expected to come in. The 10 banks are enumerated as follows: 1 Japanese, 3 Korean, 5 Taiwanese, and 1 Singaporean.

Foreign banks are seen to help drive foreign direct investments in the Philippines, as they are likely to bring with them multinational clients who are in search of business and income opportunities.

The Philippines has several world class investment promotion agencies (IPAs), each of which offer various forms of fiscal incentives, such as income-tax holidays, tax- and duty-free importation of raw materials and capital equipment, preferential tax of 5 percent on gross income, net operating loss carry-over (NOLCO), accelerated depreciation, etc. The IPAs include the Board of Investments (BOI), Clark Development Corp. (CDC), Philippine Economic Zone Authority (PEZA), Subic Bay Metropolitan Authority (SBMA), Authority of the Freeport Area of Bataan (AFAB), BOI-Autonomous Region of Muslim Mindanao (BOI-ARMM), and Cagayan Economic Zone Authority (CEZA).

Amid encouraging developments in the business climate of the Philippines, the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) favorably cited the country in its 2017 Trade and Investment Report.

UNESCAP noted that while most Southeast Asian countries experienced drop in foreign direct investments (FDIs) in 2016, the Philippines enjoyed growing FDIs. That year, net inflow of FDIs hit $8.0 billion, up 41.5 percent year-on-year.

Also, UNESCAP said Philippine external trade will be brisk. It projects volume of exports to grow by 13.1 percent and 6.2 percent in 2017 and 2018, respectively. In addition, it projects volume of imports to grow by 14.9 percent and 6.5 percent in the same periods.

Indeed, as UNESCAP has stated, the Philippines is a rising star in the Asia-Pacific region in terms of attracting FDIs.

Consistent with its goal of a truly inclusive economy, the Philippines is seeking to attract investments in a wide range of sectors, such as housing and urban development, manufacturing, connectivity, education services, tourism-related services, financial services, health services, countryside development, and agricultural development, among others.

For more information on doing business with the IPAs, visit:

###

1