Grade 12 Economics Exam Memo

September 2010.

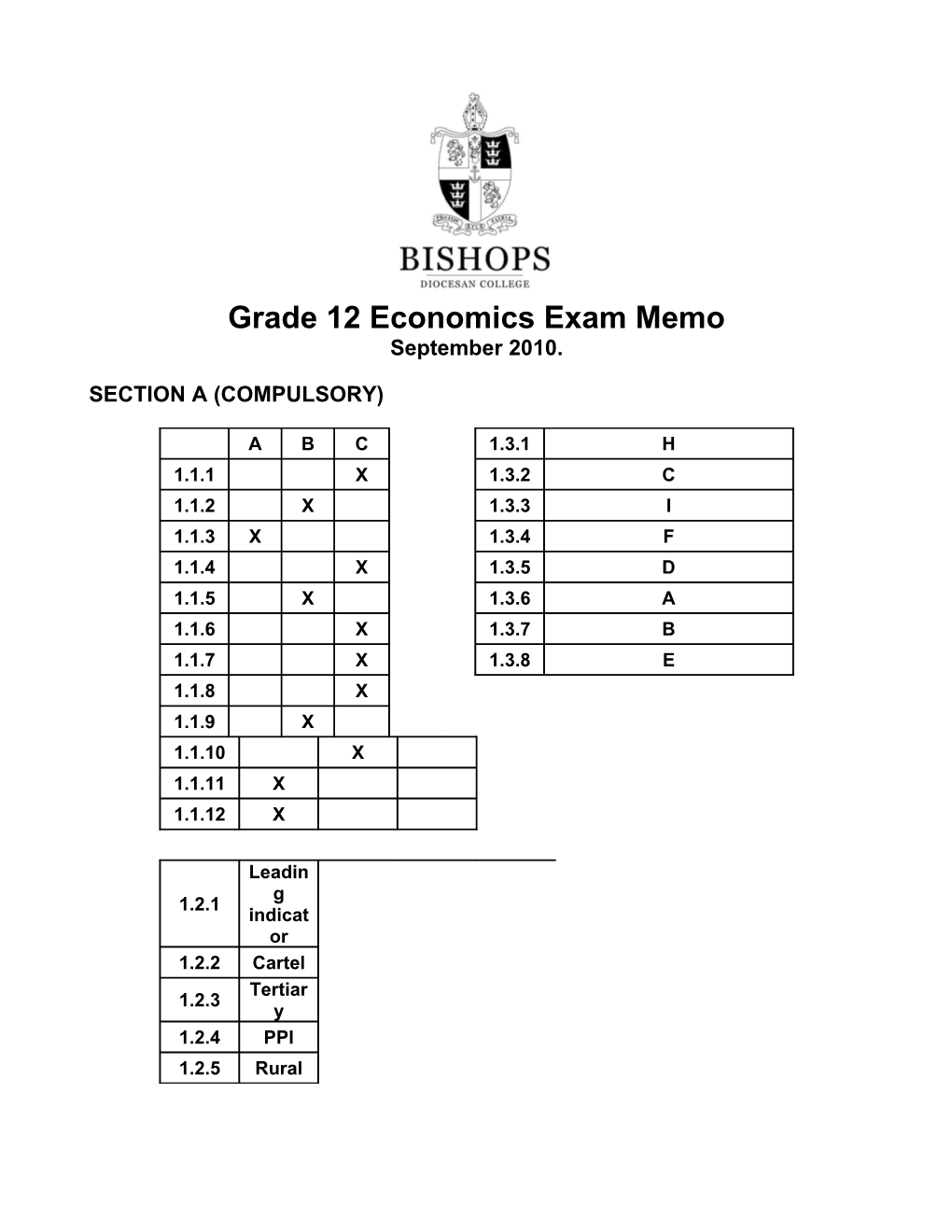

SECTION A (COMPULSORY)

A / B / C / 1.3.1 / H1.1.1 / X / 1.3.2 / C

1.1.2 / X / 1.3.3 / I

1.1.3 / X / 1.3.4 / F

1.1.4 / X / 1.3.5 / D

1.1.5 / X / 1.3.6 / A

1.1.6 / X / 1.3.7 / B

1.1.7 / X / 1.3.8 / E

1.1.8 / X

1.1.9 / X

1.1.10 / X

1.1.11 / X

1.1.12 / X

1.2.1 / Leading indicator

1.2.2 / Cartel

1.2.3 / Tertiary

1.2.4 / PPI

1.2.5 / Rural

SECTION B

QUESTION 2: (LO1 - MACROECONOMICS)

2.1.1free rider

2.1.2restrictive

2.1.3GDP

2.1.4depreciating

2.2Provides government with additional funds.

Broadens the tax base which increases government revenue.

Improves the efficiency of the economy.

Attracts foreign investment.

Decreases pressure the government budget.

Promotes black economic empowerment.

Reduction of personal income tax and public debt. Any (3 x 2)

2.3.1Successive periods of increasing or decreasing economic activity

2.3.2(a)C-D or C-E

(b)A-E or C-G

2.3.3C

2.3.4Weather conditions, war, technological changes, fuel price shocks etc

Any acceptable answer (1 x 2)

2.3.5Extrapolation

2.3.6In times of downturns: expansionary fiscal and monetary policy - decrease taxes and increase government spending; decrease the Repo rate.

In boom periods: deflationary fiscal and monetary policy - increase taxes and decrease government spending; increase the repo rate

Automatic stabilisers

2.4Economic growth

Full employment

Price stability

BOP stability

Redistribution

Environmental sustainability (+ acceptable explanation)Any (4x4)

[50]

QUESTION 3: (LO2 - MICROECONOMICS)

3.1.1imperfect

3.1.2lower

3.1.3marginal

3.1.4implicit

3.2a few producers

homogenous or heterogeneous product

significant barriers to entry

significant market control. Any (3 x 2)

3.3Study the table below and answer the questions that follow.

Quantity / Total revenue / Marginal revenue / Total cost / Marginal cost / Average cost0 / 0 / 10 / 0

1 / 20 / 20 / 18 / 8 / C

2 / A / 20 / 30 / 12 / 15

3 / 60 / 20 / B / 16 / 15.3

4 / 80 / 20 / 66 / 20 / 16.5

5 / 100 / 20 / 90 / 24 / 18

6 / 120 / 20 / 118 / D / 19.6

3.3.1A = 40, B = 45.9, C = 18, D = 28

3.3.210

3.3.3Perfectly competitive, TR increases at a constant rate / MR is constant.

3.3.420

3.3.54

3.3.6R14

3.3.7Normal profit is equal to the best return that the firm's self-owned, self-employed resources could earn elsewhere. It includes the cost of the owner's time and capital and is included in the firm's economic costs

Anything earned over and above normal profit equal to economic profit

3.4Public goods

Nobody can be excluded from consumption (non-rivalry)

Everybody can consume simultaneously (non-excludable)

Non-rejectability: individuals may not be able to abstain from consuming them even if they want eg street lighting

Examples of public goods: traffic lights, defence force, street lights, public parks

Non-rivalry and non-excludability: cannot make a profit by rendering these goods/service

Cannot charge a price: therefore demand and supply do not determine the price

Public goods not provided by price mechanism – producer cannot withhold goods for non-payment.

State finance public goods through taxation and provide it themselves.

Barriers to market entry

Certain factors prevent people from entering the market

Result in fewer participants on the markets

Markets then do not meet the requirements of perfect markets

Examples of barriers include rules and regulations imposed by the government

Examples: need a license to trade, keeps sellers out of the market (telecommunication industry, liquor license, etc)

Huge cost to begin production / or to sell is also a barrier keeping people out of the market

e.g. to build a new railway line / new harbour is too expensive

Lack of knowledge / lack of capital is also a barrier in the market

Leads to a monopoly in the market

Externalities

Cost or benefit that someone pays for or gains although he is not involved with production or consumption of the product or service

Sometimes in ideal market conditions some people gain or others suffer due to prevailing of externalities.

Two types of externalities: negative or positive

Negative externalities: examples air pollution, tobacco smoking, alcohol abuse

Part of this cost is not carried by producer but by consumer

e.g. link between smoking and certain diseases, public and public sector pay for treatment of these diseases

Producers should actually pay for this

Product is therefore “cheaper” than it should actually be

Leads to higher production of dangerous products at lower prices

Market failure occurs because sellers are not asking the “full” price

Positive externalities: certain benefits derived from use of products

Cannot place a value on these benefits, consumers would have paid more / were willing to pay more and buy larger quantities of the product

Consumers do not pay the “full” price = market failure

Merit and demerit goods

Merit goods:

Some goods highly desirable for general welfare – not highly rated by market – leads to too little consumed – market failed.

Eg health care and education, safety – merit goods

Few people would pay for education if they had to meet full cost – results in market failure

Common method to overcome market failure – for state to provide them

Demerit goods:

Eg cigarettes, alcohol and non-prescription drugs – over-consumed.

Consumer unaware of true cost of consuming them

Government can ban their consumption or reduce it through taxation and provide information about their harmful effects.

Incomplete information and uncertainties

Information only available to certain people (producers / sellers)

Buyers / consumers unaware of certain things, could be exploited by sellers

Examples: car salesmen, stock brokers and estate agents

Market cannot function optimally because everybody does not everything about the market

Workers do not know everything of the business / industry, or are unaware of other opportunities outside of their current situation, can therefore not operate fully in labour market

Entrepreneurs lack of information about costs, availability and productivity of some factors of production – operating on basis of incorrect info about reliabilityand lifespan of machines in use.

Price discrimination

Consumers pay different prices for exactly the same product

Example: airfare for the same flight

Must have incomplete information of product, cannot re-sell after purchase and difficult to compare prices

Immobility of production factors

Markets cannot adapt very easily to changes in demand and supply

Market can therefore not operate optimally, slow reaction of supply on changes in demand

Labour takes time to move occupationally and geographically – adjust slowly and inadequately.

Unskilled workers not able, willing or have time to gain necessary skills.

Physical capital infrastructure like telephone lines – can move from one location to another at irregular intervals

Structural changes occur slowly – demand increases or decreases –technology used like robots – takes time for labour-intensive textile production to be switched to computor assisted production.

Unequal distribution of income and wealth

People have the opportunity to earn income and increase wealth in the economy

But not all people have access to the same opportunities

Not all people have the same access to education and training

Discrimination (race and gender) takes opportunities away from people

Therefore not all people have the same chance to participate in the market

Any (4x4)

[50]

QUESTION 4: (LO 3 – ECONOMIC PURSUITS)

4.1.1ad valorem

4.1.2development

4.1.3spatialdevelopment initiative

4.1.4export promotion

4.2Low Standards of Living

Low Levels of Productivity

High Population Growth Rate

High and Increasing Levels of Unemployment

Dependence on the Primary Sector

Political Instability

Uneven Distribution of Income Any (3 x 2)

4.3.1World Trade Organisation (WTO)

4.3.2Promote free trade

4.3.3Tariffs, Farm subsidies

4.3.41st world / developed countries

Tariffs: are taxes on imports and shift the supply curve upwards by the amount of tax. As a result, the cost of imported goods rises and less is demanded.

Farm subsidies: are payments made to domestic farmers and as a result the price of their produce is lower than it should be and makes domestic production more attractive than imported goods.

4.3.5The North-South divide refers to developed (usually northern) countries and developing (usually southern) countries.

The cartoon illustrates this by showing the developing countries as poor pulling a cart, walking and producing basic commodities such as watermelons and mealies. The developed countries on the other hand,are represented as driving off in a luxury car and having little interest in the developing world. (6)

4.4The South African approach focuses on three areas:

(i) Effectiveness and efficiency of markets

Effectiveness should involve some discussion regarding employment equity and broad-based black economic empowerment

Efficiency should include a discussion on government encouraging competition, deregulating markets and privatisation

(ii) Business efficiency

Basically this involves incentivising effort and efficiency.

The focus is on taxes, capital formation, human resources and free advisory services.

(iii) Cost of doing business

This involves reducing cost of transport, communication and energy

. (16)

[50]

QUESTION 5: (LO 4 – CONTEMPORARY ISSUES)

5.1.1sells

5.1.2invisible

5.1.3Rotterdam Convention

5.1.4renewable

5.2interest rates

cash reserve requirements

open market operations

moral persuasion

exchange-rate policy Any (3 x 2)

5.3Study the reading below and answer the questions that follow.

Air pollution costs SA R4bn in healthcare

Air pollution is responsible for more than R4-billion in health costs, the Department of Environmental Affairs said on Monday.

"Healthcare costs associated with the burning of fossil fuels amount to R4-billion," the department's national air quality officer Peter Lukey told reporters in Vanderbijlpark at the Air Quality Governance Lekgotla.

He said the poor were disproportionally affected by air pollution. "They carry a burden because firstly they are poor and secondly they are sick. In addition, the poor often live in poorly ventilated areas and use coal fires for heat and cooking.

Lukey said during apartheid times living areas for the poor were often designated in areas downwind from industrial plants as no one else wanted to live there.

Source: Mail & Guardian Online

5.3.1Cost imposed on society by decision makers (producers or consumers) who do not take into account in their actions

5.3.2Air pollution

5.3.3

The optimum equilibrium for society would be where the marginal social cost is equal to the marginal social benefit (Q2). However, a free market left to itself will produce where the marginal private cost is equal to the marginal private benefit (Q1). In the reading, air pollution is represented by the difference between MC and MSC. If there are negative externalities in production, a private market will therefore tend to over-produce a good at too lower cost.

5.3.4If the government want to fully correct the market failure then the amount of the tax needs to be equivalent to the external costs. This would then shift the supply curve to be identical to the marginal social cost curve and correct the market failure. In practice this is very difficult as it can be a problem quantifying the value of the external costs.

5.3.5Explain why you think the poor seem to be the most vulnerable section of the population with regard to the negative impact of this market failure. (6)

5.4Demand-pull inflation

Demand-pull inflation occurs when AD increases while AS remains the same (excess demand “pulls up” prices of goods and services). (see diagram above)

Demand-pull inflation is caused by any increase in the various components of AD

- C: due to e.g. lower interest rates

- I: due to e.g. improved business confidence

- G: due to e.g. unemployment programs

- X: due to e.g. improved world economic conditions.

Demand-pull inflation can have positive impact on output as long as the economy is not at full employment. It can be countered by restrictive monetary and/or fiscal policies (i, G, t).

Cost-push inflation.

Cost-push inflation is triggered by increases in the cost of production (which “push-up” prices).

Five main sources:

- increases in wages and salaries

- increases in the cost of imported capital and intermediate goods

- increases in profit margins

- decreased productivity

- natural disasters.

All resulting in a situation of stagflation (see diagram above).

To avoid cost-push inflation, an incomes policy needs to be pursued. Restrictive monetary and fiscal policies would result in output losses (see earlier notes).

N.B. Both demand-pull and cost-push inflation can act as triggers for inflation. However, they cannot explain the on-going process that is inflation. The distinction between demand-pull and cost-push inflation eventually becomes blurred.

[50]

QUESTION 6: (LO1 MACROECONOMICS AND LO 3 – ECONOMIC PURSUITS)

6.1.1three

6.1.2revaluation

6.1.3IDZs

6.1.4WTO

6.2Injections: government spending, investment, exports

Leakages: taxes, saving, imports

6.3.1an economic indicator measures or highlights performance of the economy or some part of the economy

6.3.2SARB / StatsSA

6.3.3Exports of goods and services; imports of goods and services; income receipts; income payments; current transfers

6.3.4The value of all final goods and services produced within the borders of South Africa during one year.

6.3.5As PCE/GDP increase, the deficit on the current account increases

6.3.6As incomes/GDP increase so consumption on all goods and services increases. This means more imports – both for consumers who want imported consumer goods but also for producers who need imported inputs in order to manufacture more goods locally. This means the BOP is put under pressure as evidenced in the graph.

6.4To protect young or incipient enterprises

- higher production costs of young enterprises because they cannot enjoy the benefits of mass production

- prices higher - turnover decreases

- consumers would rather buy cheaper imported products

- protection of some sort (say customs duties) increase the price of imported articles and in doing so give the local enterprise an opportunity to develop

To prevent unemployment

- If goods are produced locally, more people can be employed in local industries

- Without protection, more goods will be imported, local production will decrease and more people will be unemployed

To prevent dumping

- it occurs when countries sell surplus stocks of goods and services in other countries at prices that are lower than their production costs

- forces young industries out of the market

- tariffs of up to 100% are often levied on foreign products to eliminate the disadvantages of dumping

To eliminate a deficit on the current account of the balance of payments

- income derived from exports used to pay for imports

- when deficits occur alternative sources of financing are sought

- should such sources not exist - either have to curtail imports or increase exports to eliminate deficit

- protection measures used to reduce imports

- foreign countries - countermeasures - only used in short term

Prevent the disadvantages inherent in over-specialisation

- free trade (no limitations on imports or exports) encourages countries to specialise in one or two products in which they enjoy a comparative advantage

- could be very dangerous because it makes the country very dependent on foreign countries

- sanctions, wars or boycotts make these countries very vulnerable

- if the prices of the products these countries produce suddenly drops (eg gold) the country will suffer huge losses eg Brazil with coffee - poor climatic conditions

- protection therefore encourages national independence by creating a more differentiated production structure, which ensures economic stability

Renders an additional income for the government

- Import taxes and other payments creates more income for the government

Any (4 x 4)

[50]

SECTION B TOTAL: [150]

SECTION C (Answer TWO questions from this section)

QUESTION 7: (LO 1 - MACROECONOMICS)

Use the theory of supply and demand to explain why exchange rate fluctuations occur under a freely floating exchange rate regime. (50)

QUESTION 8: (LO 2- MICROECONOMICS)

“Monopoly and perfect competition represent two extremes along a continuum of market structures. At the one extreme is perfect competition, representing the ultimate of efficiency achieved by an industry that has extensive competition and no market control. Monopoly, at the other extreme, represents the ultimate of inefficiency brought about by the total lack of competition and extensive market control.”

Compare, contrast and explain the long run equilibrium position of a perfectly competitive firm with that of a monopoly. Your answers should include well labelled and relevant diagrams.

(50)

QUESTION 9: (LO 3- ECONOMIC PURSUITS)

“When people speak of economic development in South Africa they usually do so within the context of the need to increase the standard of living of the poor and previously disadvantaged citizens of our country. But equally important is the issue of regional development and policies aimed at achieving a more even and efficient spread of economic activity within our country.”

Critically discuss this statement and outline South Africa’s current regional development policy. (50)

QUESTION 10: (LO 4- CONTEMPORARY ISSUES)

Tourism affects the economy in the following ways:

GROSS DOMESTIC PRODUCT (GDP)

- One economic fact about tourism is certain, is the fact that it impacts more on the service industry than on agriculture or manufacturing.

- Its contribution is directly and indirectly :

Direct contribution:

- Economic developments of the tourism sector is important, its total direct contribution to the economy is estimated at R93,6 bn for 2004,

- when GDP amounted to R1 387 bn (according to the World Travel and Tourism Council - WTTC) This means that tourism contributes 6.8 % in total.

Indirect contribution:

- Tourism is basically a service based industry partly responsible for the service sectors growth in South Africa.

- In developing countries the sector is responsible for around 40 % of GDP,

- while it is responsible for more then 65 % of GDP in developed economies.

- In South Africa it is similar to that of developed countries. Services contributed more then 65 % of GDP in 2004.

EMPLOYMENT:

- The WTTC estimated that tourism in South Africa created 1.12 million jobs in 2004.

- Tourism is the world’s largest generator of jobs for the following reasons:

- Its labour intensive

- It employs many skills

- It can provide immediate employment

- It provide entrepreneurial opportunities

POVERTY:

- Tourism is widely recognized as one of the fastest and more effective redistribution mechanisms in development.

- It brings development to the poor in rural areas.

- Many of the prime tourism attractions are located in the rural areas and not in the city centers.

- It offers opportunities in to diversity sources of income for poor people by:

- Allowing them a stake to operate small scale tourism.

- Empowering them to exploit opportunities on the job and other training

- Creating partnership with mainstream tourism businesses supplying goods or services.

EXTERNALITIES: