Corporations: Introduction and Operating Rules 2-1

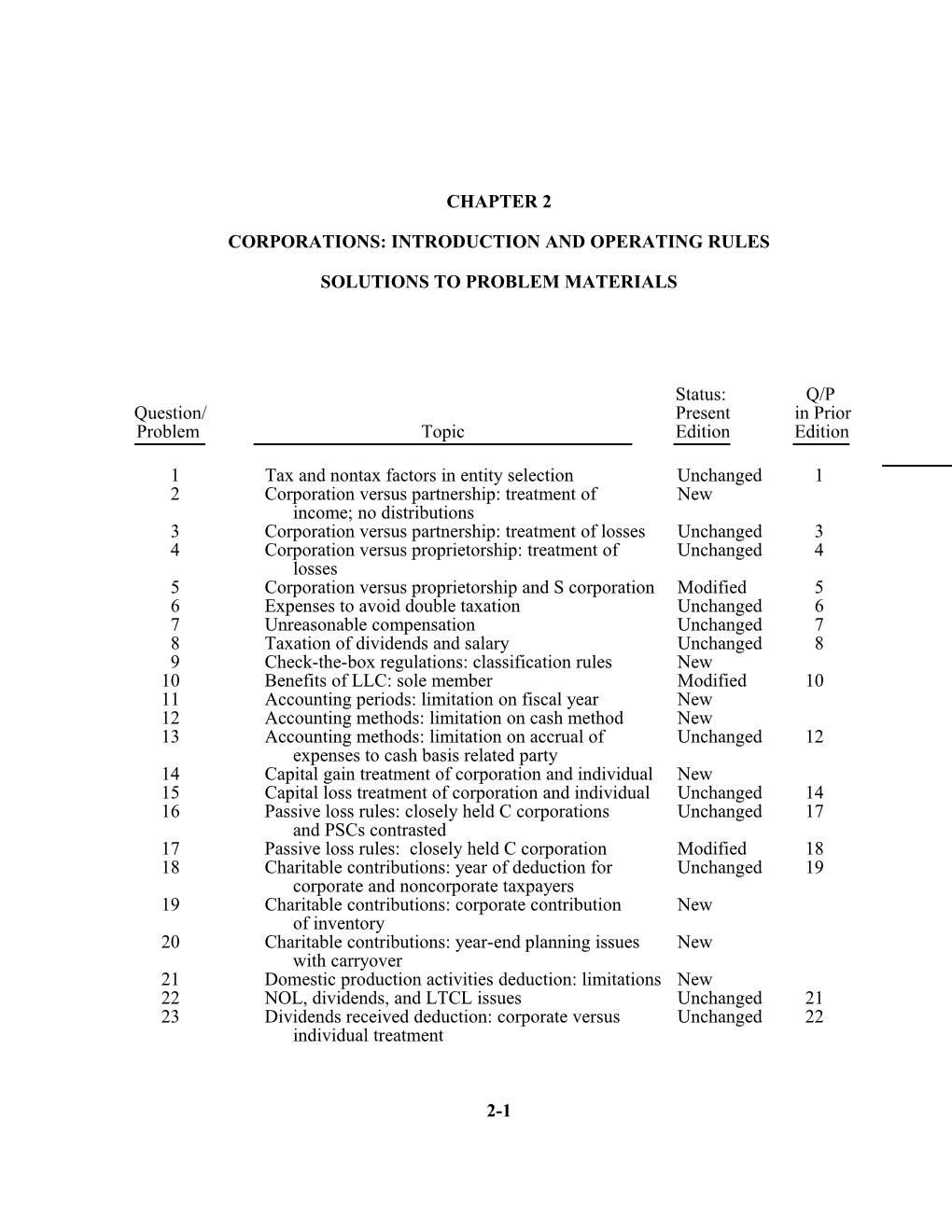

CHAPTER 2

CORPORATIONS: INTRODUCTION AND OPERATING RULES

SOLUTIONS TO PROBLEM MATERIALS

Status: / Q/PQuestion/ / Present / in Prior

Problem / Topic / Edition / Edition

1Tax and nontax factors in entity selectionUnchanged1

2Corporation versus partnership: treatment ofNew

income; no distributions

3Corporation versus partnership: treatment of lossesUnchanged3

4Corporation versus proprietorship: treatment ofUnchanged4

losses

5Corporation versus proprietorship and S corporationModified5

6Expenses to avoid double taxationUnchanged6

7Unreasonable compensationUnchanged7

8Taxation of dividends and salaryUnchanged8

9Check-the-box regulations: classification rulesNew

10Benefits of LLC: sole memberModified10

11Accounting periods: limitation on fiscal yearNew

12Accounting methods: limitation on cash methodNew

13Accounting methods: limitation on accrual of Unchanged12

expenses to cash basis related party

14Capital gain treatment of corporation and individualNew

15Capital loss treatment of corporation and individualUnchanged14

16Passive loss rules: closely held C corporationsUnchanged17

and PSCs contrasted

17Passive loss rules: closely held C corporationModified18

18Charitable contributions: year of deduction forUnchanged19

corporate and noncorporate taxpayers

19Charitable contributions: corporate contribution New

of inventory

20Charitable contributions: year-end planning issues New

with carryover

21Domestic production activities deduction: limitationsNew

22NOL, dividends, and LTCL issuesUnchanged21

23Dividends received deduction: corporate versusUnchanged22

individual treatment

Status: / Q/PQuestion/ / Present / in Prior

Problem / Topic / Edition / Edition

24Organizational expendituresUnchanged23

25Start-up expendituresUnchanged24

26Tax liability of related corporationsUnchanged25

27Schedule M-1: adjustmentsUnchanged26

28Schedule M-3: objective of scheduleUnchanged27

29Schedule M-3: income from partnershipUnchanged28

30Financial accounting considerations: FAS 109 New

deferred tax assets and liabilities

31Financial accounting considerations: FIN 48 New

applicable entities

32Compare LTCL treatment for corporations andUnchanged29

for proprietorships

33Tax treatment of income and distributions fromUnchanged30

partnership, S and C corporations

34Corporationversus proprietorship:with Modified31

distributions

35Corporation versus single-member LLC: lossesModified32

*36Corporation versus proprietorship: after-taxModified33

comparison

37Comparison of deduction for casualty loss forUnchanged34

individual and corporate taxpayers

*38Tax liability determination as proprietorship orUnchanged35

corporation

39Personal service corporation: salary requirementsModified36

for use of fiscal year and tax rate

40Accounting methods: related party expense; New

cash versus accrual

41Capital gains and losses: tax rate on LTCG New

for corporation versus individual

42Capital loss of corporationUnchanged37

43Comparison of treatment of capital losses forModified39

individual and corporate taxpayers

44Capital gains and losses of a corporation;Unchanged40

carryback/carryover

45Passive loss of closely held corporation; PSCModified41

46Charitable contribution of inventoryNew

by corporation

47Corporate charitable contributionUnchanged43

48Charitable contributions of corporation;Modified44

carryover

49Timing of charitable contributions deduction:Unchanged45

taxable income limit

50Domestic production activities deductionUnchanged46

*51Net operating loss: computed with dividendsNew

received deduction

*52Dividends received deductionModified48

53Organizational expensesUnchanged49

*54Organizational expensesModified50

*55Determine corporate income tax liabilityUnchanged51

Status: / Q/PQuestion/ / Present / in Prior

Problem / Topic / Edition / Edition

*56Schedule M-1, Form 1120Unchanged53

57Schedule M-1, Form 1120New

58Schedule M-3, Form 1120Modified55

59Schedule M-3, Form 1120Modified56

60Schedule M-3, Form 1120Modified57

61Schedule M-3, Form 1120Modified58

62Financial accounting considerations: FIN 48 New

recognition and measurement

63Tax issues involved in starting a new businessUnchanged59

in the corporate form

Tax ReturnProblem

1Corporation income tax (Form 1120)New

2Corporation income tax (Form 1120)New

ResearchProblem

1Member’s personal liability for unpaid New

employment taxes of single-member LLC

2Dividends received deductionUnchanged1

3Expenditures incurred on behalf ofUnchanged3

corporation

4Internet activityUnchanged4

5Internet activityUnchanged5

6Internet activityNew

*The solution to this problem is available on a transparency master.

CHECK FIGURES

Corporations: Introduction and Operating Rules 2-1

32.a.Andrew will report profit $20,000and capital loss $5,000.

32.b.Andrew’s income is not increased.

33.a.Each partner reports $100,000 netprofit and LTCG of $30,000.

33.b.Same as a.

33.c.Corporation reports $260,000income. Shareholder reports$40,000 dividend income.

35.a.Losses not passed through toshareholder.

35.b.Deduct $153,000.

36.a.After-tax income $73,328.

36.b.After-tax income $66,702.

36.c.After-tax income $59,256.

37.a.$50,900 itemized deduction.

37.b.$67,500.

38.a.$36,050.

38.b.$29,450.

38.c.$23,420.

38.d.$33,658.

39.a.$60,000.

39.b.$24,000.

40.a.$0.

40.b.$110,000.

41.a.$22,250.

41.b.$15,000.

42.a.$75,000.

42.b.$93,000.

43.a.$18,000 deducted 2008; $6,000carried forward to 2009.

43.b.$15,000 deducted 2008; $9,000 carriedback to 2005, then 2006, etc.

44.a.Offset short-term capital gain of$90,000 against net long-term capital

loss of $570,000. The $480,000 netcapital loss is carried back 3 yearsand forward 5 years.

44.b.Total carryback $420,000.

44.c.$60,000; carry forward to 2009, etc.

44.d.Deduct $93,000 in 2008, $477,000 carried forward indefinitely.

45.Offset $80,000 of passive loss against active income. No offset if a PSC.

46.a.$30,000.

46.b.$50,000.

46.c.$60,000.

48.a.$29,000.

48.b.Excess $6,000 carried forward.

49.2008.

50.a.$36,000.

50.b.$37,500.

51.a.$116,000.

51.b.Carryback 2 then forward 20.

52.Green $70,000; Orange $140,000; Yellow $112,000.

53.a.$5,072.

53.b.$6,107.

53.c.$5,072.

53.d.$6,107.

54.$3,700.

55.Purple $7,200; Azul $108,050; Pink $113,900; Turquoise $2,278,000; Teal $7,910,000.

56.$120,000.

57.$195,000.

Corporations: Introduction and Operating Rules 2-1

DISCUSSION QUESTIONS

1.You should ask questions that will enable you to assess both tax and nontax factors that will affect the entity choice. Some relevant questions are addressed in the following table, although there are many additional possibilities.

Question / Reason for the questionWhat type of business are you going to operate? / This question will provide information that may affect the need for limited liability, ability to raise capital, ease of transferring interests in the business, how long the business will continue, and how the business will be managed.

What amount and type of income (loss) do you expect from the business?

What is the amount and type of income (loss) that you expect from other sources? / Income from a business will eventually be reported on the tax returns of the owners.

For example, income (loss) from a partnership, S corporation, or LLC will ‘‘flow through” to the owners. Dividends from a C corporation must be reported on the tax returns of the shareholders. Any income (loss) from other sources will also be reported on the returns of the owners. Thus, for planning purposes, it is important to know all sources and types of income (loss) that the owners will have.

Do you expect to have losses in the early years of the business? / Losses of partnerships, S corporations, and LLCs flow through to the owners and represent potential deductions on their individual returns. Losses of a C corporation do not flow through.

Will you withdraw profits from the business or leave them in the business so it can grow? / Profits from a partnership, S corporation, or LLC will ‘‘flow through” to the owners, and will be subject to taxation on their individual tax returns. Profits of a C corporation must be reported on the tax returns of the shareholders only if such profits are paid out to shareholders as dividends. Thus, in the case of a partnership, S corporation, or LLC, owners must pay tax on profits before plowing funds back into the business. In the case of a C corporation, the corporation must pay tax on its profits.

pp. 2-2 to 2-6

2.Arnolddoes not report any of Yellow Corporation’s income because no dividends were paid during the year.However, he must report his $49,000 (35% partnership interest × $140,000 partnership income) share of Pastel Partnership’s income on his individual tax return. p. 2-3

3.Art should consider operating the business as a sole proprietorship for the first three years. If he works 15 hours per week in the business, he will exceed the minimum number of hours required to be a material participant (52 × 15 = 780). Therefore, he will be able to deduct the losses against his other income. When the business becomes profitable, Art should consider incorporating. If he reinvests the profits in the business, the value of the stock should grow accordingly, and he should be able to sell his stock in the corporation for long-term capital gain. pp. 2-2 to 2-6

4.Losses of sole proprietorships are passed through to their owners, but losses (operating or capital) of regular corporations are not. Capital losses of sole proprietorships retain their character when reported by the proprietor.

The capital loss of the sole proprietorship is passed through to Lucille, and she is allowed to report it on her tax return as a capital loss. She can offset the loss against capital gains or deduct it against ordinary income (up to $3,000) if she has no capital gains for the year.The capital loss of Mabel’s corporation is reported on the tax return of the corporation, which is a separate taxable entity. It has no effect on her taxable income.

The operating loss is passed through to Lucille, and she is allowed to deduct it on her tax return (subject to at-risk and passive loss limitations). The operating loss of the corporation has no effect on Mabel’s tax return.

pp. 2-2, 2-3, and 2-12

5.Conner should report the information on his individual tax return as follows:

If SE is / Conner should reporta.A proprietorship / $120,000 profit on Schedule C, $5,000 capital loss on Schedule D (subject to capital loss limitation). The $80,000 withdrawal would have no impact on Conner’s individual tax return.

b.A C corporation / $80,000 dividend (profit withdrawn from SE). Neither the $120,000 profit nor the $5,000 capital loss would flow through.

c.An S corporation / $120,000 profit and $5,000 capital loss would flow through from SE to Conner and be reported on his individual tax return. The capital loss would be combined with any personal capital gains (losses), and would be subject to the $3,000 limit. The $80,000 withdrawal would have no impact on Conner’s individual tax return.

pp. 2-2 to 2-6

6.If Tanesha buys the warehouse and rents it to the corporation, she can charge the corporation the highest amount of rent that is reasonable. The rental operation can help her to bail some profits out of the corporation and avoid double taxation on corporate income. The depreciation and other expenses incurred in connection with the warehouse will be deductible by Tanesha, which should enable her to offset some or all of the rental income. If the rental property produces a loss, Tanesha can use the loss to offset any passive income she might have. If Tanesha has the corporation buy the warehouse, the revenue and expenses related to the building will be included in the computation of corporate income. If there is a profit, Tanesha can bail it out as a dividend, which will be taxed at a 15% rate. pp. 2-4, 2-35, and 2-36

7.To the extent a salary paid to a shareholder-employee is considered reasonable, the corporation is allowed a deduction. To the extent a salary payment is considered unreasonable, the payment is treated as a dividend and is not allowed as a deduction.

a.Vivian reports the $400,000 as salary and pays tax on it at a marginal rate of 35%. The corporation has a $400,000 deduction.

b.Vivian reports the $400,000 as dividend income and pays tax at a preferential rate of 15%. The corporation is not allowed to deduct the $400,000 dividend.

c.Since the shareholder-employee is taxed on both salary ($300,000) and dividends ($100,000), double taxation on $100,000 has occurred. The preferential rate of 15% applies to the dividends. The corporation has a deduction for the reasonable compensation amount, or $300,000, but not the $100,000 dividend.

p. 2-4

8.Al will be subject to a 15% rate on the $20,000 that ABC pays him as a dividend, but ABC will not be allowed to deduct the amount in computing corporate taxable income. Jay will report the additional $20,000 that JKL pays him as salary and will be taxed at his marginal rate of 35%. JKL will be allowed to deduct the salary payment in computing corporate taxable income. p. 2-4

9.The “check-the-box” Regulations guide the Federal taxation of LLCs. In the case of an LLC with two or more members, an election may be made to treat the entity as a corporation. Absent such an election, the LLC is treated as a partnership for Federal tax purposes. In the case of a single-member LLC, an election may be made to treat the entity as a corporation. Absent this election, the entity is disregarded for Federal tax purposes and the sole member (proprietor) reports the income (loss) of the LLC on his or her individual return. p. 2-8

10.The primary nontax advantage of LLC status is limited liability for the sole member. Depending on the laws of the state of formation, other nontax advantages (e.g., centralized management, free transferability of ownership interests) may exist. The primary tax advantage of LLC status is that Erica can avoid the double taxation effect associated with a C corporation. Under the “check-the-box” Regulations and absent an election to the contrary, the LLC is disregarded and Erica reports the income (loss) of the LLC on her individual return. p. 2-8

11.A personal service corporation (PSC) generally must use the calendar year for tax purposes. A PSC is a corporation whose principal business activity is the performance of personal services (e.g., legal, accounting, architectural, health) and such services are substantially performed by shareholder-employees. A fiscal year may be elected in somecases (e.g., business purpose for year can be demonstrated). S corporations are subject to similar limitations on the use of fiscal tax years. p. 2-10

12.In general, a corporation is not allowed to use the cash method of accounting for Federal tax purposes. However, S corporations, qualified personal service corporations, and C corporations engaged in the trade or business of farming or timber are exceptions to this rule. Further, a C corporation with $5 million or less of average gross receipts over the past three years is allowed to use the cash method.

a.Red Corporation has $8 million of average gross receipts over the 2005-2007 period. Thus, Red must use the accrual method of accounting (unless it satisfies one of the other exceptions).

b.White Corporation has $4 million of average gross receipts over the 2005-2007 period. Thus, White satisfies the gross receipts exception and may use the cash method of accounting.

p. 2-11

13.A corporation that uses the accrual method cannot claim a deduction for an expense involving a related party until the recipient reports that amount as income. Jeong, a cash basis taxpayer, must report the rent income in 2009, the year she receives the payment. The corporation may deduct the rent expense in 2009, the year Jeong is required to report it as income. p. 2-11

14.Both corporations and individuals include recognized net capital gains in their taxable income. For a corporate taxpayer, such income receives no preferential rate treatment and is taxed at the same rates as the entity’s ordinary income. For an individual taxpayer, however, a net capital gain is taxed at maximum rate of 15%. p. 2-12

15.Kathy may use her $25,000 LTCL to offset any capital gains she has during the year. If she has losses in excess of gains, she may deduct up to $3,000 of the losses as a deduction for AGI, and any remaining losses may be carried forward indefinitely.

Eagle Corporation may use the capital loss to offset any capital gains recognized during the year. Any excess losses may be carried back three years and forward five years. When carried back or forward, a long-term capital loss is treated as a short-term loss. p.2-12

16.a.If Osprey is a personal service corporation, it cannot deduct any of the passive loss.A personal service corporation cannot offset a passive loss against either active or portfolio income.

b.A closely held corporation that is not a personal service corporation can offset passive losses against active income but not against portfolio income. Therefore, Osprey can deduct $180,000 of the $270,000 passive loss.

p. 2-12

17.A closely held C corporation that is not a personal service corporation can offset a passive loss against active income, but not against portfolio income. Hummingbird can deduct only $70,000 of the $90,000 passive loss. Example 15

18.Individuals cannot deduct contributions until they are actually made. Therefore, Andrea must wait until 2009 to deduct the contribution. Aqua Corporation, whose board of directors authorized the contribution in 2008, can deduct the contribution in 2008, as the pledge was paid on or before March 15, 2009. Example 16

19.In general, a charitable deduction for a contribution of appreciated inventory is limited to the basis of the contributed property. However, in the case of a contribution of inventory to a charitable organization that uses the property for the care of the ill, needy, or infants, a corporate taxpayer may obtain an increased deduction. In such cases, the charitable deduction is limited to the lesser of (1) the sum of the property’s basis plus 50% of the appreciation on the property or (2) twice the property’s basis. Example 20

20.The following tax issues should be considered.

●Is Orange an accrual method taxpayer and, if so, will the contribution be made by March 15, 2009, so as to obtain a deduction in 2008?

●Will the contribution consist of property or cash?

●If the contribution consists of property, what is the character of the property (capital gain or ordinary income property) and amount of the contribution deduction?

●What is the current year’s taxable income limitation on the deductibility of charitable contributions?

●In what tax year did the charitable contribution carryover originate and when does the 5-year period for such carryover expire?

●If the $45,000 sum of the current year’s contribution plus the carryover amount exceeds the taxable income limitation, should the current year’s gift be deferred to the subsequent tax year?

pp. 2-13 to 2-15

21.The domestic productions activities deduction for 2008 is equal to 6% of the lesser of the taxpayer’s (1) qualified productions activities income or (2) taxable income. However, the deduction cannot exceed 50% of the corporation’s W-2 wages related to qualified productions activities income. p. 2-15

22.Finch Corporation must determine whether it had a net operating loss (NOL) in 2009. In making this determination, consider the operating loss, the dividend received, and the dividends received deduction. The long-term capital loss (LTCL) is not allowed. However, Finch may carry the LTCL back to 2007 and 2008 to offset any capital gain in those years.

An NOL may be carried back two years and forward 20 years to offset taxable income. If Finch has an NOL for 2009, it must decide whether to carry the NOL back to prior years or forward to future years. It should forgo the NOL carryback if tax rates in the two preceding years were low and if higher rates are expected in the future. Before electing to forgo an NOL carryback, however, a corporation should be able to predict with confidence that future profits will be higher.

Examples24 and 40

23.Otter Corporation will be allowed a dividends received deduction equal to 80% of the $240,000 dividend (subject to possible limitations described in Example 25). It will pay tax at the applicable corporate tax rate of 25% on the remaining portion of the dividend. Gerald must include the entire $240,000 dividend and will pay tax at the 15% rate applicable to individuals. Examples 3 and 25

24.a.Expenditures that qualify for amortization include the following: legal services incident to organization (such as costs of drafting the corporate charter, the bylaws, the minutes, and the terms of original stock certificates); necessary accounting services; expenses of temporary directors and of organizational meetings of directors or stockholders; and fees paid to the state of incorporation.

b.Expenditures that do not qualify are those connected with the issuing or selling of shares of stock or other securities (e.g., commissions, professional fees, and printing costs) or with the transfer of assets to a corporation.

c.Amortization is over a period of 180 months. The period begins with the month in which the corporation begins business. Amortization is conditioned on an election. If an election is not made, organizational expenditures cannot be deducted until the corporation ceases to do business and liquidates. However, if the corporate charter limits the life of the corporation, the expenditures could be amortized over such life.